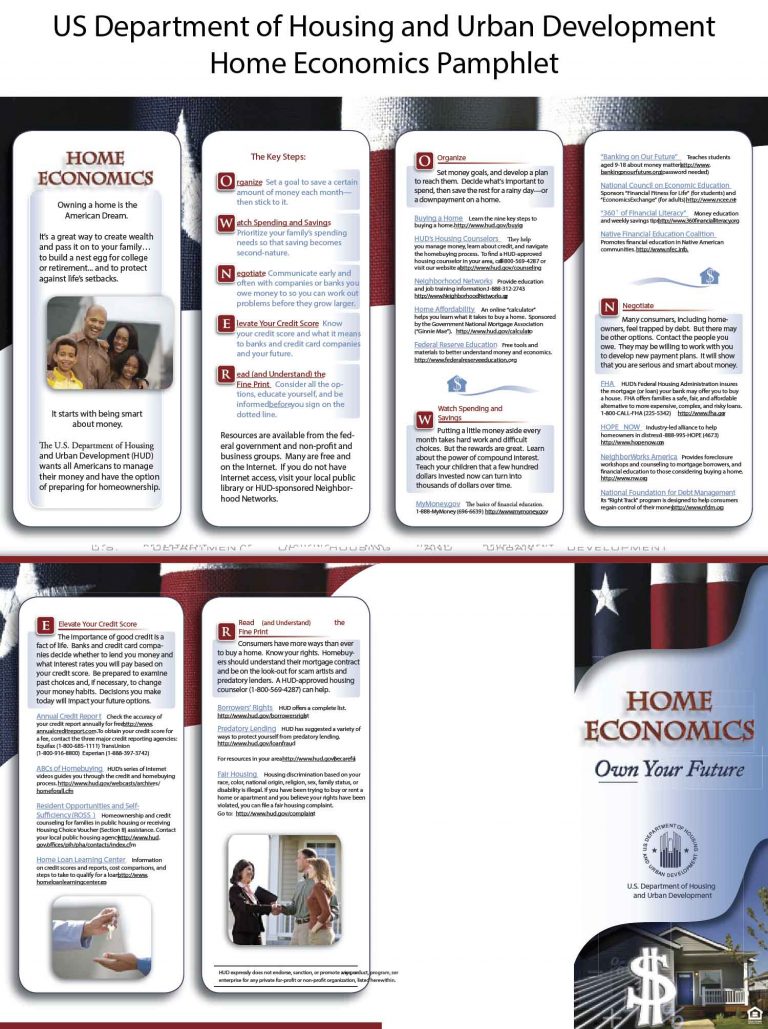

What is a Mortgage?

Making good decisions about the home that you purchase to live in (or as an investment) is critical for being prosperous and building your financial wealth. To help you make better decisions with regard to how you’ll finance your home or another property, this article covers the essentials of how mortgages, not only answering the…