FHA Recommendations for Home Ownership

The Federal Housing Authority, a division of the United States Department of Housing and Urban Development and the world’s largest insurer of home mortgages, was created to help people in the US achieve the goal of owning a home. To that end, FHA is heavily involved in helping people have access to home ownership, everything from providing subsidized access to mortgage loans (its most significant role) to providing education around home ownership and financing the purchase of a residence.

Lending Tree (an affiliate partner of Prosperopedia.com) gives you access to FHA lenders who can quickly quote a rate and get you started with the loan application process.

Click on the Lending Tree banner below if you’d like to see what’s available.

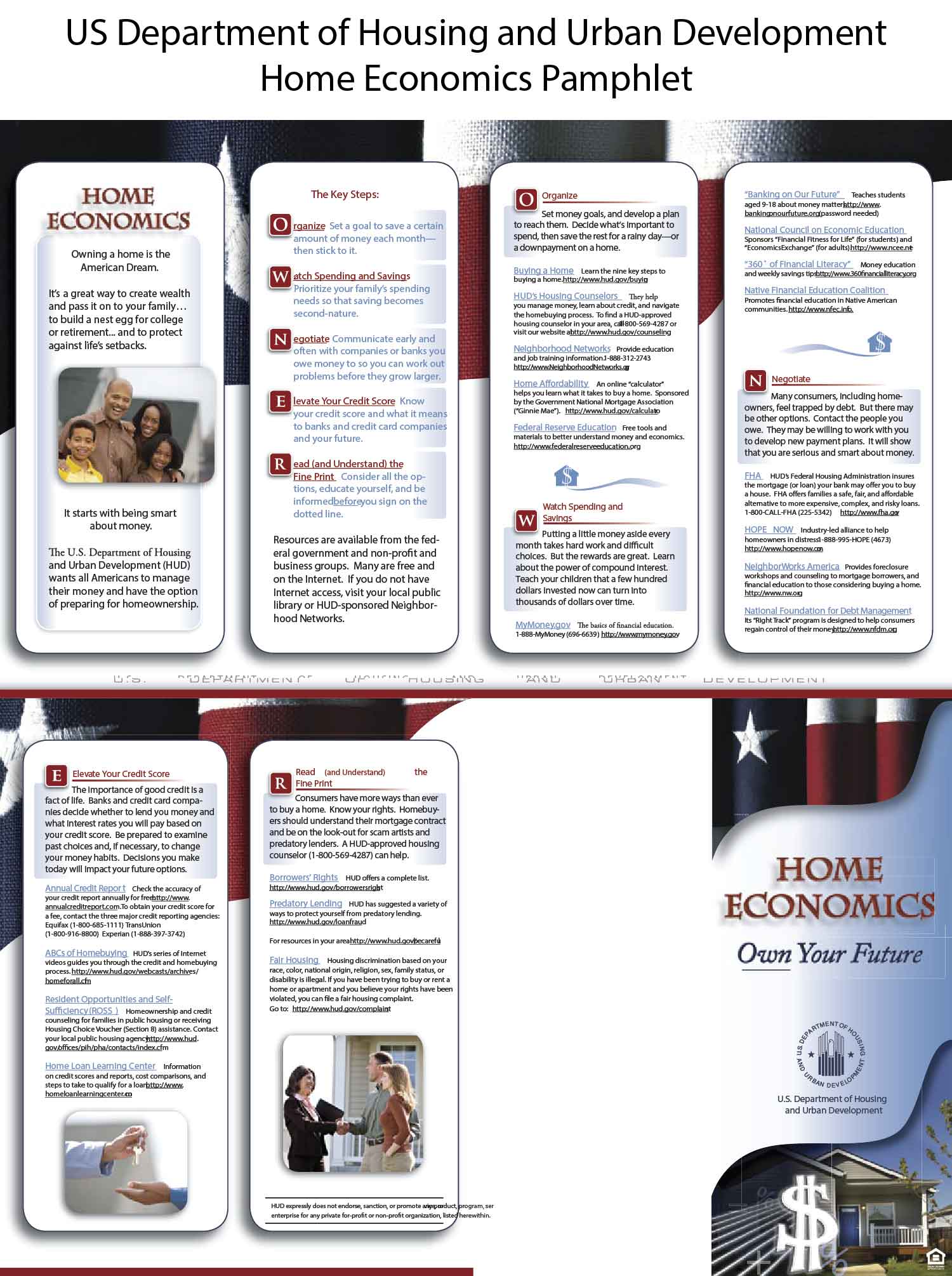

FHA’s Home Economics Pamphlet

As part of its role as an educator regarding home ownership and financing, HUD and the FHA publish a pamphlet entitled “Home Ownership”, which addresses what they consider to be the “Key Steps” involved in preparing to purchase a home, financing the purchase of a home, and establishing habits that help your home purchase be a good experience rather than a burden for you and your family.

In fact, the Home Economics brochure makes the assertion that “Owning a home is the American dream.” You may have heard that said before. Well, indeed having a space to call your own can indeed be a dream. However, as many have found out in the past decade, not being prepared to be a homeowner can often result in that dream becoming a nightmare, as unaffordable mortgage payments and other costs associated with being a home owner shorten the honeymoon and bring stress into your life.

With that context, I will review the FHA recommendations laid out in the Home Ownership pamphlet. I am also including an image of the pamphlet here for you to review as well.

FHA Home Owner Key Steps: O.W.N.E.R

The Key Steps of home ownership presented by HUD are cleverly made into an acronym that spells OWNER. They include:

- Organize: Set a goal to save a certain amount of money each month— then stick to it.

- Watch Spending and Savings: Prioritize your family’s spending needs so that saving becomes second-nature.

- Negotiate: Communicate early and often with companies or banks you owe money to so you can work out problems before they grow larger.

- Elevate Your Credit Score: Know your credit score and what it means to banks and credit card companies and your future.

- Read (and Understand) the Fine Print: Consider all the options, educate yourself, and be informed before you sign on the dotted line.

In their explanation of these key steps for home ownership, the FHA also includes resources to help potential home buyers educate themselves or otherwise get help from professionals to improve their chances of being successful at accomplishing each of these key steps. I will summarize those resources and includes links to them below.

If you have low credit, it is likely a good idea to get your credit fixed before applying for a loan to buy a house. Our affiliate partner CreditRepair.com can help you take the steps you need to fix your credit, which will get you a lower interest rate and more favorable mortgage terms.

Click on the banner below if you’re interested in getting help from CreditRepair.com

Organize

Preparing to buy a home starts well before you begin shopping and put an offer on something you like. The organize part of preparing for home ownership involves budgeting, saving money for a down payment on the home, and taking control of your finances such that home ownership will not be a financial burden.

HUD Recommendation: Set money goals, and develop a plan to reach them. Decide what’s important to spend, then save the rest for a rainy day—or a downpayment on a home.

Resources

- Buying a Home: The HUD 9-step guide for preparing to buy a home

- HUD Housing Counselors: HUD-sponsored housing counseling agencies who can help with the home buying process

- Home Affordability Calculator: The original HUD-linked calculator no longer exists. This link goes to Zillow’s tool.

Watch Spending and Savings

HUD Recommendation: Putting a little money aside every month takes hard work and difficult choices. But the rewards are great. Learn about the power of compound interest. Teach your children that a few hundred dollars invested now can turn into thousands of dollars over time.

Resources

- MyMoney.gov: Financial Literacy and Education Commission website for educating US citizens about finances.

- National Council for Economic Education: educational programs for children and educators

- 360 Degrees of Financial Literacy: a public service educational website about financial literacy provided by the American Institute of CPAs.

Negotiate

HUD Recommendation: Many consumers, including homeowners, feel trapped by debt. But there may be other options. Contact the people you owe. They may be willing to work with you to develop new payment plans. It will show that you are serious and smart about money.

Resources

- FHA: the Federal Housing Authority exists to mitigate home mortgage risks and give homeowner access to people who otherwise would not qualify.

- Hope Now: a non-profit that helps advocate for home ownership by providing mortgage assistance, including down payment assistance programs.

- NeighborWorks: foreclosure workshops and counseling

- National Foundation for Debt Management: debt counseling for homeowners

Elevate Your Credit Score

HUD Recommendation: The importance of good credit is a fact of life. Banks and credit card companies decide whether to lend you money and what interest rates you will pay based on your credit score. Be prepared to examine past choices and, if necessary, to change your money habits. Decisions you make today will impact your future options.

Resources

- Annual Credit Report: Federally mandated credit report available for free once annually.

- Mortgage Bankers Association Consumer Tools: education about credit scores, shopping for loans, and qualifying for loan approval

If you have low credit, it is likely a good idea to get your credit fixed before applying for a loan to buy a house. Our affiliate partner CreditRepair.com can help you take the steps you need to fix your credit, which will get you a lower interest rate and more favorable mortgage terms.

Click on the banner below if you’re interested in getting help from CreditRepair.com

Read (and Understand) the Fine Print

HUD Recommendation: Consumers have more ways than ever to buy a home. Know your rights. Homebuyers should understand their mortgage contract and be on the look-out for scam artists and predatory lenders.

Resources

- Fair Housing Complaints: file a complaint regarding fair housing issues

- HUD Exchange Toolkit: consumer protection resources to avoid mortgage fraud and other mortgage related issues

Following the O.W.N.E.R recommendations from the HUD and FHA will help you more successfully find, finance, and purchase a home that will be a benefit to you and your family instead of being a negative experience.