How to Get Out of Debt

If you have substantial debt, you’re much like the average American, who carries a personal debt load of about $30,000. That number doesn’t even include a mortgage, which is usually considered a good kind of debt. Instead, that $30,000 average debt load (as reported by Northwestern Mutual’s 2019 Planning and Progress Study) on Americans consists of payments being made for credit cards, car loans, student loans, and similar kinds of personal debt.

The study referenced above from Northwestern Mutual also found that 15% of Americans believe they’ll never be out of debt for the rest of their lives. How defeated is that?

But that’s not you! It’s time for you to get out of debt. That’s why you’re reading this article.

I’ve always been somewhat leery of debt ever since I can remember. Owing money to someone else, to a company or to some other entity, often feels like bondage, like there is something hanging over your head thats keeping you from living life to its fullest.

Despite that natural leeriness we all have towards , our modern credit-based materialistic society has a way of influencing a person against his better judgement, and I’ve also found myself at times falling into the trap.

In this article, I’m going to share with you the principles and practices I’ve learned about how to get out of debt, including examples from my own journey going from having debt to having significant wealth. After all, to reach the ultimate financial potential and achieve prosperity, your objective shouldn’t be just to get out of debt, but to build your wealth such that you can enjoy life more fully and have more capability to give back to others who might be trying to follow along a similar path to financial security.

At its essence, getting out of debt essentially consists of bringing in more income than you spend. Viewed in this context, getting out of debt or avoiding ever getting into debt in the first place sounds like a really simple objective. Mathematically, if you make $5,000 in a month (which represents about $30/hour in a forty-hour work week), and you spend $4,500 in a month, you should have $500 per week left over, right?

We all know life is not nearly that simple. Your $5,000 per month income is beholding to taxes and other government withholdings. In a dynamic world, where you might get sick or injured and can’t work, Many people work jobs that are commission based or otherwise fluctuate. Small business owners like me

Despite all of the variableness of life when it comes to income and expenses, two things need to happen in your life: more income and less expenditures. To get out of debt and stay out of debt, you need to be assertive about controlling those two elements of the financial equation as best you can. If you’re really interested in getting out of debt, you know that you can always do better.

I’m going to explain what steps you’ll need to take to get out of debt, which will reduce your stress level, allow you to start building financial wealth, and improve your overall quality of life.

For most people, getting into debt involves a several areas of negligence regarding finances. Excluding those who have simply had unusual misfortune because of unavoidable health and medical issues or some kind of accident, people who are in debt typically have not used a budget. They haven’t paid attention to what’s happening with their money. They are casual about controlling their income versus their expenses. They tend to be impulsive and can’t pass up what might appear to be a good deal. They haven’t been assertive about education and increasing their income.

In order to get out of debt, the biggest obstacle you’ll need to overcome is changing your mind about money and training yourself to be disciplined, to treat money as a servant rather than as a master.

I’m going to approach getting out of debt using a fairly straightforward list that I’ve seen work for me and many other people I know who are debt-free and/or wealthy.

Here are the items on that list that you’ll need to do:

- Develop a financially responsible mindset and learn to be disciplined

- Reduce and manage your expenses

- Increase your income

- Set specific financial goals

Believe me, if you can get a grip on this little checklist, you can get yourself out of debt.

Before I get into the details of how you’ll get yourself out of debt, I’m going to share a quick testimonial from Justine, who runs the Debt Free Millenials YouTube channel. Justine paid off $35,000 in 2 1/2 years on just a $37,000 income.

Let’s walk through the components of your plan to become debt free.

Developing a Financially Responsible Mindset and Learning to be Disciplined

If you take a serious look at the behavior that has gotten you into debt, it should be apparent that you need to change your perception on money and finances. Often, financial irresponsibility is a learned behavior, meaning that it came from being taught the wrong things about finances from parents or simply not being taught the right things about money. Many times, having the wrong attitude towards money comes from being entitled by parents or others who have shielded you from the consequences of not managing your finances enough to reinforce bad habits.

Whatever your background, it’s time to change your perspective on money!

Changing your mindset about finances takes some serious resolve. Often people have a hard time doing it alone without assertively changing lots of thing about their lives, shedding bad habits and weaving new, good habits into their lives.

The best way I can think of to develop a financially responsible mindset is to associate yourself with others who already have that mindset, or who are on a journey similar to yours.

You need to find and become part of a community of people who are determined to get out of debt themselves, and to help others get out of debt. Often, communities like the one you need involve a particular program or methodology that is being followed.

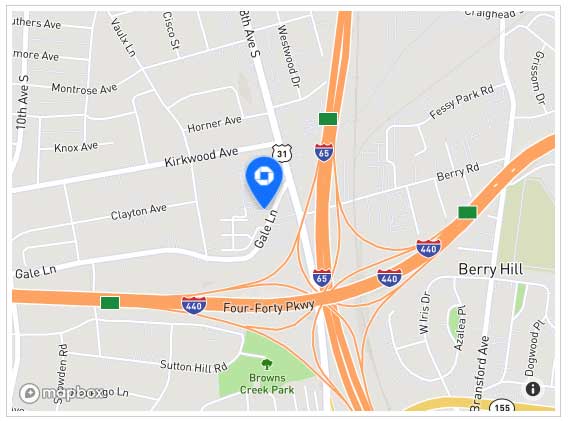

For instance, you may have heard of Dave Ramsey, likely the most popular person in the United States when it come to helping people get out of debt. Well, Mr. Ramsey has a program called Financial Peace University (available for about $130) that is taught at many local churches and community centers. You can search for a class near you by entering your city or zip code on the Financial Peace University sign up page.

There are lots of other local classes that bring together groups of people who are working towards getting out of debt. My own church, The Church of Jesus Christ of Latter-day Saints, has regular self-reliance groups that are designed to help members start on getting out of debt using a 12-week program outline. They don’t cost anything, and they include the concept of having an “accountability partner” to whom you report your progress throughout the week.

If you’re not ready to jump in and join a group yet, the least you can do is begin regularly listening to media streams of these people who are experts at getting out of debt. You can tune in to Dave Ramsey’s radio show each day of the week, and you’ll find your attitude towards money start to change as you listen to people call in and get advice about their specific situations.

To give you an idea of what a debt elimination program looks like, here is a list of the “Baby Steps” used in Dave Ramsey’s debt elimination and wealth building program. You can read more details about these 7 baby steps here. Many of the steps deal directly with debt, and others work on building your wealth.

- Baby Step 1 – Emergency Fund: Save and set aside $1,000 that you can use for emergencies.

- Baby Step 2 – Begin Paying off Debt: Use the debt snowball approach to pay off debts, beginning at the smallest and working up to the largest.

- Baby Step 3 – Expense Fund: Save enough money to cover 3-6 months of expenses.

- Baby Step 4 – Begin Investing: Invest 15% of your income into Roth IRAs and pre-tax retirement funds.

- Baby Step 5 – College Fund: Set aside money for your children to attend college using 529 college savings plans or Educational Savings Accounts (ESAs).

- Baby Step 6 – Pay Off Home: Avoid wasting money on mortgage interest payments by paying as much as possible to get rid of your mortgage.

- Baby Step 7 – Build Wealth: Put your money to work and build wealth while also contributing to charitable causes and to your posterity.

Reducing and Managing Your Expenses

No matter how much money you make, if you don’t learn to manage your expenses, you’ll find that you can always spend as much money as you make, and you often look back and wonder where your money went.

Tracking Your Expenses Habit: One of the first steps to effectively managing your expenses, bringing them in line with your life vision, is to simply track every expense you have over the course of a month.

You can start this habit today. Simply create an entry in a spreadsheet, a notes app on your phone, or whatever is the most convenient, whenever you spend any money. Record the amount you spend on your groceries, your cell phone, cable, internet, and other regular bills, your mortgage or rent payment, money spent out on a dinner date, going to the movies, everything!

At the end of the month, tally up how much you spent. You’ll likely be surprised not just at the total, but at some of the amounts you spend on various “categories” of expenditures, even if you haven’t officially formalized your spending categories in an official budget.

Simply starting down the path of discipline by tracking your expenses is a powerful way to put some distance behind you on your way to creating the more thorough and complete budgeting system that will shore up your finances.

After you’ve started tracking your expenses, you start to have a much more informed understanding of how your hard earned income is returned back to the world in the form of expenses. You can now begin to form strategies based upon the data you’re observing. For instance, you might look at your car payment and have the epiphany that you don’t need such an expensive ride. You might decide to sell it and get something that doesn’t require payments, but that works for you functionally and gets you where you need to go. You might realize that you’re spending way too much on soft drinks and snacks, on eating out, on other habits that you’ve known weren’t great, but now you can see more clearly what the financial impact is, you can make up your mind to reduce or eliminate those expenses from your spending habits.

Creating a Budget: The next major step is to create a budget, which acts as a monthly, weekly, and daily way to ensure that you spend with intent, not by accident. Managing expenses using a budget allows you apply a higher-level perspective to what you’re doing on a daily basis. As you prayerfully, thoughtfully plan on a regular basis what you should be spending your money on, then put that plan into action during your daily interactions with spending opportunities, you will have greater control over what’s going out of your account.

Increasing Your Income

The other side of this debt elimination equation is obviously how much income you make. It makes sense that the more money you have available to put towards paying off debts, the quicker those debts will be gone, and you can start using that extra money to invest and build wealth.

The quickest way to increase your income is to pick up more hours at your day job, get another job part time, or take advantage of some of the many ways that exist to make money outside of your full-time job. Many of the financial gurus recommend getting a part-time job delivering pizzas or waiting tables, jobs that don’t require long-term commitments, but that can be used to quickly pay down debts that may be costing you far too much in interest. Quickly adding a few hundred extra dollars per week to pay down the principal will have a compounding effect on that money’s ability to pull you out of debt.

There are many jobs, including doing freelance writing and other one-off contract work, that you can do from home or that you can fit into 30 minute blocks of time. Those opportunities give you even more flexibility with regard to snagging some extra cash to use for exterminating your debt.

If you’re in a situation where your income versus debt scenario means that you’ll be paying off your debt for years, you might consider how to quickly gain the skills and tooling you need to increase your income substantially at your full-time job. For instance, many companies will give a promotion or pay raise for an employee who passes a certification or demonstrates a skill that the company attaches more value to. Some people find it appealing to change their career altogether to something that is simply more lucrative, but that doesn’t take a lot of time (like a 4-year college degree program) to get into. Sales jobs are often opportunities to increase your income substantially without needing to spend significant time and expense getting a drawn out formal education at a university. An entire industry has been launched out of the constant need technology companies have for software developers and other technically skilled employees. Those who have the propensity for it can enter a technology boot camp program and learn a completely new, highly valuable skill set in a matter of a few months, seeing their income go up by as much as double what they earned in their previous career.

Regardless of how you want to approach this income side of the occasion, it’s worthwhile to consider whether you might need to make a few changes to increase your earning power, even spending more time working, at least until you can get caught up on your debt.

Setting Financial Goals

While you’re in the business of getting rid of your debt and relieving yourself of that burden, it’s a good idea to talk about setting financial goals, even ones that go beyond debt. I’ll share my own experience with setting financial goals.

When my wife and I were married more than 16 years ago, we started our marriage with some debt, about $10,000. Although we hadn’t been entirely irresponsible with our money, we also hadn’t been very intentional. We wasted some money. We made some bad decisions. We weren’t on the best path for avoiding debt.

Together, we sat down and made a plan to eliminate our debt and to move beyond that. Our plan included reaching a million dollar net worth within 10 years of being married. To accomplish that goal, we knew we would have to become very careful about managing our expenses as well as increasing our income. We read a book called, “The Millionaire Next Door” together, and we talked about what the concepts explained in that book meant for our family in particular.

We accomplished our goal on time, and we’ve been blessed for focusing our financial attention on a shared goal that gave us a lot of freedom. We now have seven kids who we’re able to provide for, including giving them a complete education in music (which gets expensive), supporting them in participating in competitive sports (which is also expensive), and providing them with travel and other experiences that we simply would not have access to if we hadn’t set financial goals and repeatedly evaluated how we were doing in terms of those goals. We’ve also had the means to help people out through donating to charities at church and in the community, and we’ve been able to help family and friends financially because we exercised discipline early on in our marriage.

Whether you’re married or single, in addition to determining to get yourself out of debt, make a financial plan that takes you through retirement and puts you where you want to be to enjoy your future.

Get started today.

It’ll be worth it.