LDS Personal Finances Self-Reliance Budgeting Course

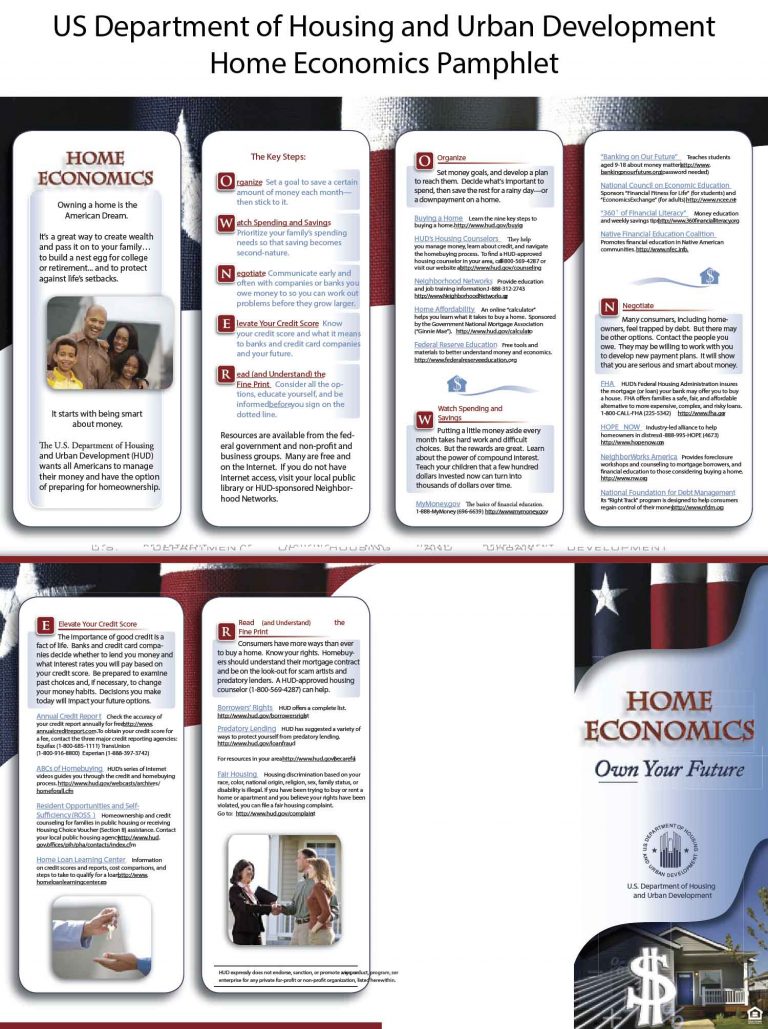

Taking control of your personal finances is one the most important things you can do to experience the blessings of prosperity that are available to those who are willing to obey the principles upon which those blessings are based. Under the influence and in the grasp of the materialistic society in which we now exist,…