Mortgages

If you’re like most people, your home is most likely your largest investment. It’s where you live, raise your family, create memories, and spend a good portion of your time.

The financing details regarding your home, whether you’re a first-time buyer, a seasoned homeowner looking to refinance, or someone interested in pulling out equity for something important, is something you should commit to knowing a bit about.

This section of Prosperopedia,com provides helpful information about mortgages, how they work, how to get the best deal, where to look for potential gotchas, and lots of other education about mortgages and financing that are such a critical part of your life.

LDS Personal Finances Self-Reliance Budgeting Course

Taking control of your personal finances is one the most important things you can do to experience the blessings of prosperity that are available to those who are willing to obey the principles upon which those blessings are based. Under the influence and in the grasp of the materialistic society in which we now exist,…

Fanny Mae Form 1003 Uniform Residential Loan Application

If you’re applying for a mortgage loan or have applied for one in the past, you’ve possibly heard of Fannie Mae Form 1003, Uniform Residential Loan Application. Form 1003 is the standard form used by most mortgage lenders to collection the information of a potential borrower necessary to determine whether the applicant is qualified to…

Buying a Home In New York City

New York City obviously has a lot going on. Its economy is the largest regional economy in the United States. New York is often considered the most financially powerful city in the world and the leading center of the world’s financial industry. Unless you’re just kind of a small town kind of person, there are…

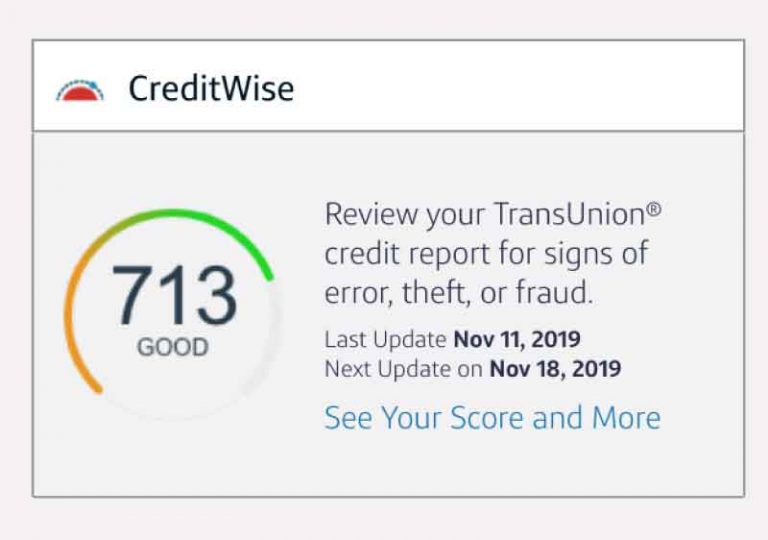

CapitalOne Creditwise Free VantageScore Credit Report from TransUnion

Article Summary CapitalOne provides free credit scores for credit card holders through their CreditWise monitoring product. When you sign up for a credit card with CapitalOne, you get access to CreditWise as a free add-on service. CreditWise uses TransUnion data to provide CapitalOne credit card holders with a credit score calculated using the VantageScore 3.0…

What is a Mortgage?

Making good decisions about the home that you purchase to live in (or as an investment) is critical for being prosperous and building your financial wealth. To help you make better decisions with regard to how you’ll finance your home or another property, this article covers the essentials of how mortgages, not only answering the…

Closest Chase Bank to Albuquerque, New Mexico

Chase Bank is one of the largest banking institutions in the United States, with nearly 5,200 branches spread throughout the country. However, if you live in the Albuquerque, New Mexico area, you’re (currently) out of luck if you bank with Chase (or want to), and you need to access a local branch. Closest Chase Bank:…

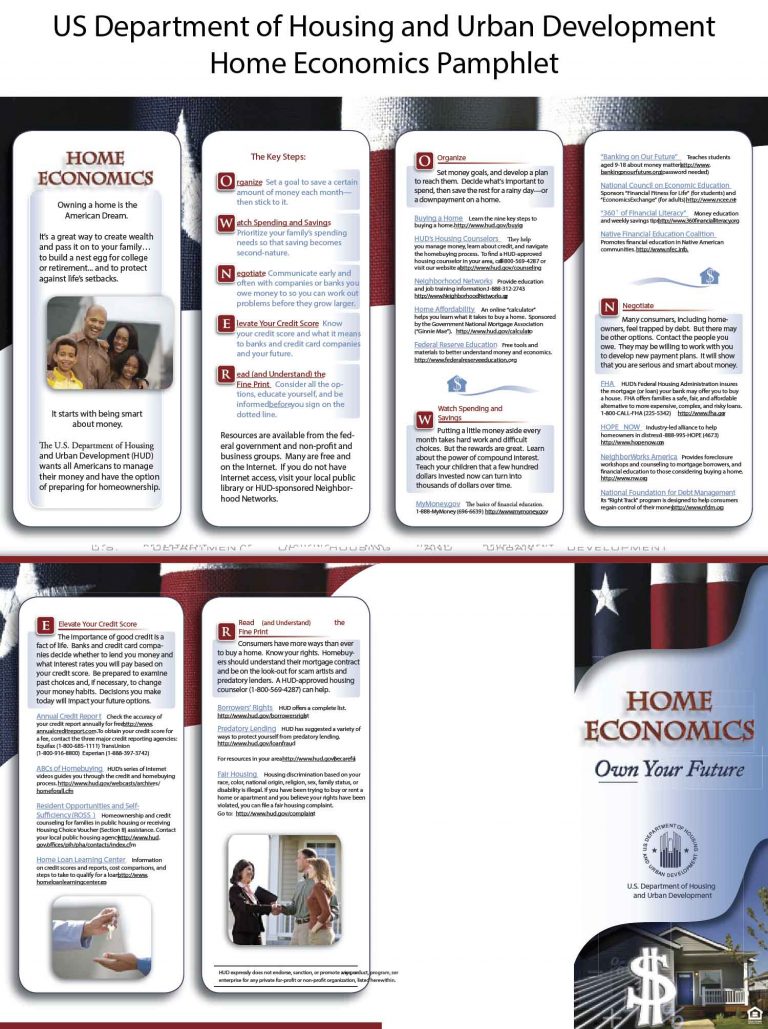

FHA Recommendations for Home Ownership

The Federal Housing Authority, a division of the United States Department of Housing and Urban Development and the world’s largest insurer of home mortgages, was created to help people in the US achieve the goal of owning a home. To that end, FHA is heavily involved in helping people have access to home ownership, everything…

Wells Fargo Debt-to-Income (DTI) Guidelines and Recommendations

Wells Fargo is one of the largest lenders in the United States, one of the biggest banking institutions in the world. They offer all sorts of loans ranging from traditional home purchase mortgages to student loans, personal loans, auto loans, and business loans. Wells Fargo knows a thing or two about lending, including what causes…

Debt to Income (DTI) Ratio Requirements for FHA Loans

Article Summary The official debt-to-income or DTI ratio guidelines for FHA home loans is 31%/43%, or 31% for the front-end ratio and 43% for the back-end ratio. These guidelines are not strictly followed among FHA lenders, who consider other factors in considering a loan application, including a borrower’s credit score, how much money is being…

Wells Fargo Bank

Our goal at Prosperopedia.com is to help you be informed about things that affect your financial well-being so that you can make decisions. In this article, we will discuss Wells Fargo Bank. I’ll explain some of the details about the bank and what products and services it offers as well as summarizing reviews that the…

When is the Best Time to Buy a House?

The decision to buy a home is a big one. Making the best decision on buying a home has a lot to do with timing. But when is the best time to buy a home? There are several factors that will affect the answer for you specifically, but this article should set some background and…

Top Real Estate Investment Books Recommended by BiggerPockets

One of the resources I’ve begun using as I’ve waded into the waters of real estate investing is an organization called BiggerPockets, which was created to encourage real estate investment by building a community and disseminating educational and other information about how to go about real estate investment. Probably the biggest hurdle (outside of having…

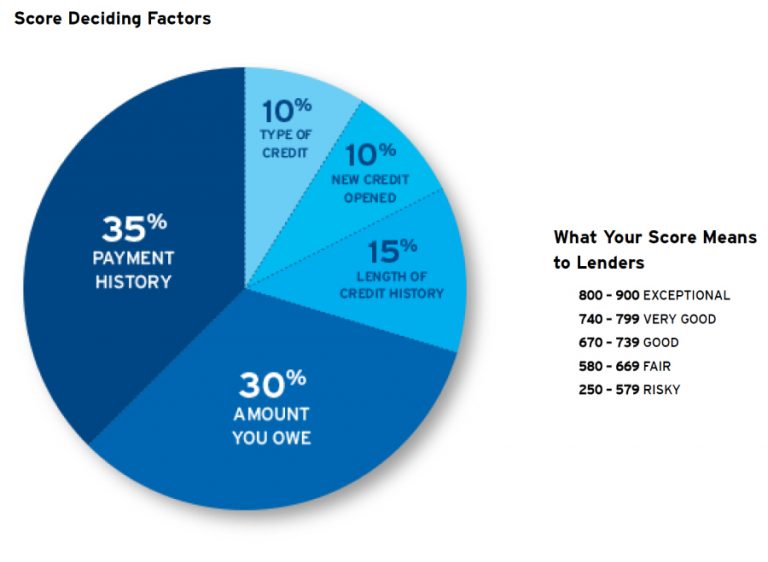

What Factors Affect Your Credit Score?

Credit Reporting Agencies and FICO Score Understanding how significantly your credit score affects your access to borrow money, you naturally want to know what factors affect your credit score. I will answer that question for you, and I’ll provide other details related to credit scores that should help you make good financial decisions as you…

Getting a Home Loan with Bad Credit

One of the primary factors lenders consider when you apply for a mortgage is your credit score. They normally use what’s called a FICO score, which is a number that ranges between 300 and 850. Lenders use this number to assess your trustworthiness, as it represents your recent and extended credit history. How you have…

Dave Ramsey’s 7 Baby Steps for Saving Money, Paying Off Debt, and Building Wealth

Dave Ramsey is a popular radio show host, an author of several books about financial management and developing life skills. Besides being a great teacher, he is also, not coincidentally, a successful businessman and a devout Christian. His Financial Peace University course has been completed by over 4 million people. Ramsey’s formalized and systemized financial…

How Much Home Can I Afford?

When you’re shopping for a home, one of the very first questions you’ll ask yourself is, “How much home can I afford?” I’ll answer that question for you in this article using the information lenders use to qualify you for a loan amount as well as some recommendations based upon my own experience buying homes….

FHA Loan Debt to Income (DTI) Ratio Guidelines

FHA Loan Debt to Income (DTI) Ratio Guidelines FHA loans allow first time home buyers and others who are just starting out or who may be financially disadvantaged to purchase homes through a government assisted program that differs from conventional loans. To qualify for an FHA loan, the Federal Housing Authority requires that you meet…

Are We Currently Experiencing A Real Estate Bubble?

Article Summary The current housing market in the US has made its way back to pre-Great Recession levels. Interest rates are rising, which will tend to cool off the increasing housing prices. Significant factors that will cause a market correction in the next two years include the Federal Reserve’s monetary policy and tightening of credit…

How To Become Rich – The Richest Man in Babylon Formula

The Richest Man In Babylon is a fictional story with sound principles that have helped people become wealthy through their application. This first part comes from the part of the book “Seven Curses For A Lean Purse”. Heed the advice in each of these sections, and your “purse” will become fat and overflowing with wealth….

How To Get Pre Approved For A Home Loan

Buying a home is a lot easier than you might think. Yes, it’s a huge purchase, probably one of the largest purchases you’re going to make in your life, but the hurdles in the process mostly deal with time. If you’ve interviewed some rockstar real estate agents to purchase your home, you’re smart, because not…