How To Get Pre Approved For A Home Loan

Buying a home is a lot easier than you might think. Yes, it’s a huge purchase, probably one of the largest purchases you’re going to make in your life, but the hurdles in the process mostly deal with time. If you’ve interviewed some rockstar real estate agents to purchase your home, you’re smart, because not very many people will filter through agents to find one you jive well with. Using an agent to buy your home is free, and if you’ve done your homework, you should have found one that has your best interest in mind.

The first thing you need to do when buying a home, before talking to a real estate agent, is to get pre-approved for financing. Getting pre-approved lets agents and sellers know you’re serious. You’ll also save a lot of headache because by getting pre-approved for a loan, you’ll see exactly how much house you can buy.

Getting pre-approved means proving that you can afford the monthly payments of a home up to a certain amount. If you’re looking at getting a $200k home and you find out you can only afford a $150k home, that can be heartbreaking. Save the heartache and get pre-approved before you start looking for a home.

When getting pre-approved, there are a few things you’ll need to get prepared. Get ready to do some paperwork hunting, so that you will have the required documentation. Below are areas that most mortgage lenders look at, but keep in mind that you may need to provide more for other circumstances.

Work History

Since the housing crisis of 2008, mortgage lenders have become much more careful of approving anyone for a home loan. More red tape has been added to getting a home loan, but still, it’s not as complicated as people think. One of the criteria lenders look at is work history—where are you currently working?, how long have you been there?, and how much do you? are a few of the essential questions they’ll ask.

One of the most common ways your employment is validated involves providing your two most recent two pay stubs as proof of employment. This verifies your employment status, wage, and any other payments you’re making like childcare. You’ll also want to make sure that if you’re thinking about quitting your job and wanting to buy a home, quitting your job during this process will affect the outcome of whether you get the loan or not.

If you’re self employed, obtaining pre-approval from a lender involves a bit more work. For self-employed borrowers, lenders want at least two years of tax returns to average out and see what you can afford. Deducting less from your self-employment expenses increases your adjusted gross income (which also increases your tax liability) and allows you to qualify for a larger loan. There are lenders that take self-employment tax write-offs into consideration when considering your net income. You’ll need to talk to your lender to find out how they calculate net income for self-employed borrowers.

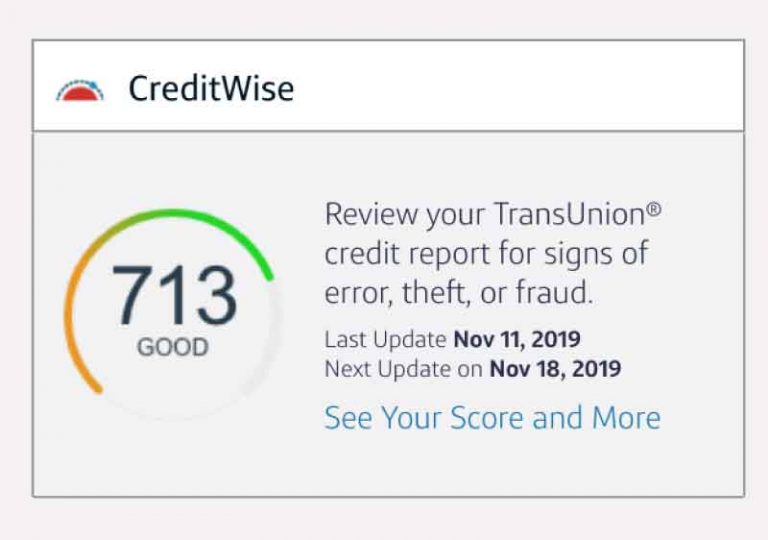

Credit History

Having a few credit cards open can helps build credit history, especially if you’re paying off your credit card balance every month. This shows lenders that you can borrow money responsibly and have a way of paying them off. A general rule of thumb to managing credit debt is to not use more than 1/3 of your credit line at any given time. Places like freecreditreport.com and Experian.com can let you do a hard pull on your credit report for free once per year. But you’ll want to avoid pulling your credit too often, especially for opening new credit cards and other consumer reasons.

When buying a home, you’ll be allowed to keep your credit report open for a certain amount of time, because credit agencies understand that you’re shopping for an affordable rate for home. During this shopping around period, you’ll also want to avoid getting your credit pulled for other reasons because it will influence whether you get the home loan or not.

If you think you have too many credit cards open and want to reduce the number or credit cards or accounts you have open, it’s not a good idea to close these accounts. You’ll want to leave your credit cards open because that line of credit, or “allowance” you’re able to borrow can dilute the amount of credit you actually own. Going back to the point of using 1/3 of your credit line, the higher your credit line or credit limit, the better you look to lenders for not maxing out your credit limit.

Debt-to-Income Ratio

How much money do you make compared to how much money you owe? Most banks and lenders will assume that 40%-50% of your income can go to debt—including your house debt.

For example, if you make $4k a month, then they’ll see that you can manage about $2k worth of debt. If you already have credit card debt, a car payment, and student loans, it may be harder to qualify for a large enough loan to get the house you want.

The key thing here is that you need to eliminate as much debt as you can up front. The less debt you have, the more house you may be able to afford. Depending on the state and if you’re looking at buying a multifamily home and live in it (aka owner-occupy), you may be able to add some of the rent that’s currently being generated from the property into your own income since you’ll likely continue to receive those rents as the new owner of the property.

For example, if you move into a duplex that has a vacancy in one part and the other part is being rented out for $1k, you might be able to add 75% of the rent to your own income to help you qualify for a larger loan. That would mean that you would potentially be allowed to add $750 to your own income which would reduce your debt-to-income ratio. If you use FHA, at the time of writing this article, you could put down 3.5% because you’d be living in the multifamily home and get your first investment property with very little down compared to the 20% down required from a traditional investor.

There are creative ways to buy homes. Your lender should help you, financially, to know what your options are. Real estate agents will then help you find the homes that fit your criteria for accomplishing your goals, whether it’s moving into your forever home, acquiring an investment property, or a finding a stepping stone to get into a bigger home down the road.

Conclusion

Getting a home isn’t complicated, it’s just time consuming. If you’re renting and want to get your own place and don’t know whether you can afford a home, talk to a lender. You don’t necessarily need to get your credit pulled, most lenders can give you a ball-park estimate of what you might be able to quality for, but they won’t know the exact amount until they do pull your credit. You don’t get any money back when you rent, when you buy a home, you’re actually putting money into an asset that may appreciate substantially over time.