National Debt Relief Program and Services

Article Summary

National Debt Relief is a New York City-based debt relief company founded in 2009 that helps clients throughout the United States reduce their unsecured debt burden through a program that includes services such as negotiating with creditors to lower the amount owed, consolidating debt and reducing the amount of interest being paid, helping with setting up a budgeting program to help clients better manage their debt load, and other similar services.

National Debt Relief’s program charges a fee of between 15% and 25% of the amount of debt that a client enrolls in their program. The fee is collected by National Debt Relief after the debt has been settled, and the exact percentage charged depends upon the state

The minimum amount of debt required to be enrolled in the National Debt Relief program by a client is $7,500. The average debt enrolled by National Debt Relief clients is over $20,000.

America’s Debt Problem

It’s no secret that America has become addicted to spending and debt over the past century. As a country, we owe more that $22 trillion in debt, which equates to over $60,000 per individual citizen.

But a much more pressing issue dealt with by most Americans is debilitating personal debt. A 2018 study by Northwest Mutual showed that the average American carries a personal debt obligation of $38,000 for things other than mortgages, including student loans, car loans, credit card debt, and other repayment obligations. As of 2017, Americans were responsible collectively for almost $4 trillion in unsecured personal debt.

Although our civilization seems to have very little discipline with spending, it’s not mandatory that everyone participate in the insanity. However, if you’re part of the majority and have found yourself swept up in the spending without budgeting hype that consumes most of our society, now would be a good time to change that.

Even for those who are severely burdened with debt, there are still options for getting back on the right track financially, even outside of declaring bankruptcy, which is very difficult to rebound from.

Debt relief is one of the solutions for those who are strapped with debt and desperate for a way out.

What is Debt Relief?

Debt relief is an approach to managing and reducing debt that includes cancelling debts where possible as well as other ways of slowing and turning around debt burdens through debt consolidation and interest rate reduction. Formal debt relief programs (including those offered by National Debt Relief) typically charge a fee (a commission on the debt being managed) to overwhelmed debtors to help them achieve a satisfactory level of debt relief.

To be considered eligible for debt relief, a consumer normally needs to show signs of being unable to keep up with debt, including being behind on payments, and normally must have a high enough level of debt (especially compared to a low enough level of income) to be considered a candidate for debt relief.

Debt relief is available only to people who can demonstrate an unusual inability to keep up with the debts they’ve incurred. It’s not a way for people to wantonly unload unwanted debt instead of being responsible for whatever choices they’ve made to incur debt.

The National Debt Relief Program

National Debt Relief is a company based in New York City that was founded in 2009 for the purpose of helping clients take on overwhelming debt through their program designed to reduce, settle, consolidate, and otherwise make debts more manageable.

Participation in the National Debt Relief program requires the following:

- an outstanding debt balance of at least $7,500 worth of unsecured (credit cards, personal loans, etc.) debt

- the ability to make a monthly payment into a settlement fund set up by National Debt Relief for the purpose of paying off debts once they have been negotiated

- a demonstrable financial hardship that would be viewed by creditors as justification for reducing the amount you owe them, such as a job loss, an unexpected health or medical crisis, or similar reasons for needing relief

Getting started with National Debt Relief’s services is done by talking to one of their debt counselors. You can fill out the form linked to below to connect with someone who can assess your personal situation.

How the National Debt Relief Program Works

When you enroll in National Debt Relief’s program, a dedicated savings escrow account is set up for you into which you are expected to begin paying money to fund settlement payments. After your escrow account is set up and you’ve deposited sufficient funds to begin making settlement offers, your National Debt Relief representative begins negotiation with your creditors to try to obtain settlement agreements for less than what you owe, typically shooting for about 50%. When a formal settlement agreement is reached between your creditor and National Debt Relief, the funds in your escrow account are used to payoff the settled debt amount and close out the account.

If you have multiple creditors, the settlement negotiation and ultimate payment to close the account are done sequentially, meaning one debt account is settled, then you move on to the next one.

In the meantime, you likely are not making payments on your accounts (it’s hard to justify claiming a hardship with your creditor if you’re current on your bills), which put them further behind. This is almost certain to negatively affect your credit score as this continued delinquency is reported to the credit bureaus.

Ultimately, this process continues for as long as you have debts that need to be settled, which can take two to four years. Also, it is possible that there are creditors who will not settle for an amount less than what you actually owe. National Debt Relief cannot force them to settle on your behalf.

What Types of Debt Are Eligible for National Debt Relief’s Program?

National Debt Relief can’t be used for all types of debt. Secured debts such as mortgages, car loans, or anything else where there is collateral used as security for the loan are not eligible for National Debt Relief’s program. Also, National Debt Relief doesn’t settle debt that is a result of back taxes owed to the IRS, debt incurred from a lawsuit, student loans, utility bills, child support, and several other types of debt.

The most common type of debt for which National Debt Relief handles negotiations and settlements is credit card debt.

Here is a list of the most common types of debts that are eligible for help from National Debt Relief:

- any major credit card: Visa, MasterCard, Discover Card, American Express, and others

- department store account cards

- gas cards

- installment loans

- unsecured personal loans

- cell phone bills where service has been disconnected

- abandoned time shares

- past due rent for a previous address

The full list of debts that can and cannot be handled by National Debt Relief is available from the debt qualifications page on their website.

How Does National Debt Relief Make Money?

National Debt Relief makes their money by taking a percentage of the amount of debt they settle for you. The percentage ranges from 15% to 25%, and depends upon the type(s) of debt you want them to settle as well as the state in which you live, which governs the settlement approach taken (more difficult means a higher fee, less difficult a lower fee) by National Debt Relief.

Using the average settlement amount stated by National Debt Relief (about $20,000) and assuming that the average percentage fee charge ends up being in the middle of the 15% to 25% number (20%), National Debt Relief would make about $4,000 average per client.

National Debt Relief Reputation and Reviews

National Debt Relief is one of the largest and oldest of the debt relief companies. They have worked with thousands of clients since they were founded in 2009. The company is accredited with the Better Business Bureau, and they have an A+ rating there. They are also members of the American Fair Credit Council.

You can take a look at their review scores and read specific reviews on several different review sites where they are listed, including:

Alternatives to National Debt Relief

There are alternatives to using National Debt Relief, including other debt relief companies whose approaches, although generally similar to National Debt Relief, vary to one extent or another. Companies like Freedom Debt Relief, Credit Associates, and Accredited Debt Relief offer similar services.

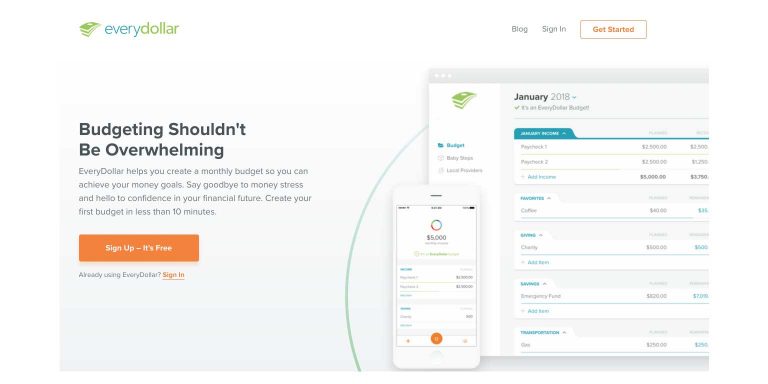

Also, the long term alternative to debt relief is much more holistic than getting into a bunch of debt that you can’t handle, then hiring someone to get some portion of it so that you can work through a settlement.

It makes more sense to get involved in something like the 7 Baby Steps program from Dave Ramsey’s Financial Peace University to not only manage your debt, but to become a much better steward over your finances so that you can build wealth and enjoy life more fully.