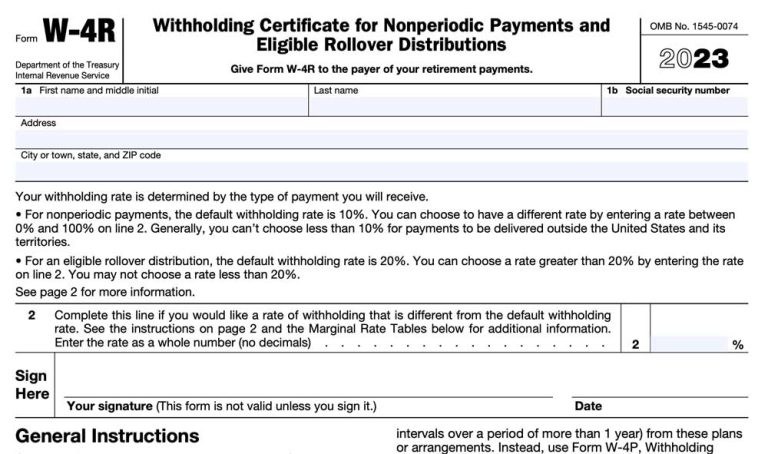

IRS Form W-4R: Income Tax Withholding for Retirement Distributions

The IRS Form W-4R is a tax form used by retirees and other recipients of pensions or annuities. This form helps these individuals calculate the amount of federal income tax that should be withheld from their payments. In this article, we will explain the purpose of the W-4R form and provide a guide to help…