LDS Personal Finances Self-Reliance Budgeting Course

Taking control of your personal finances is one the most important things you can do to experience the blessings of prosperity that are available to those who are willing to obey the principles upon which those blessings are based.

Under the influence and in the grasp of the materialistic society in which we now exist, it can be difficult to choose to be so different as to have your own personal finances in order, saving money and building wealth instead of spending every dollar of every paycheck attempting to keep up with society’s addiction to satisfying their wants, purchasing things that ultimately don’t matter. It is well known that America has a very serious debt problem. Consumer debt continued its rise in 2019, reaching a record $14 trillion as money was spent without enough intention on things like cars, student loans, and unnecessary commodities, in addition to housing and other necessities.

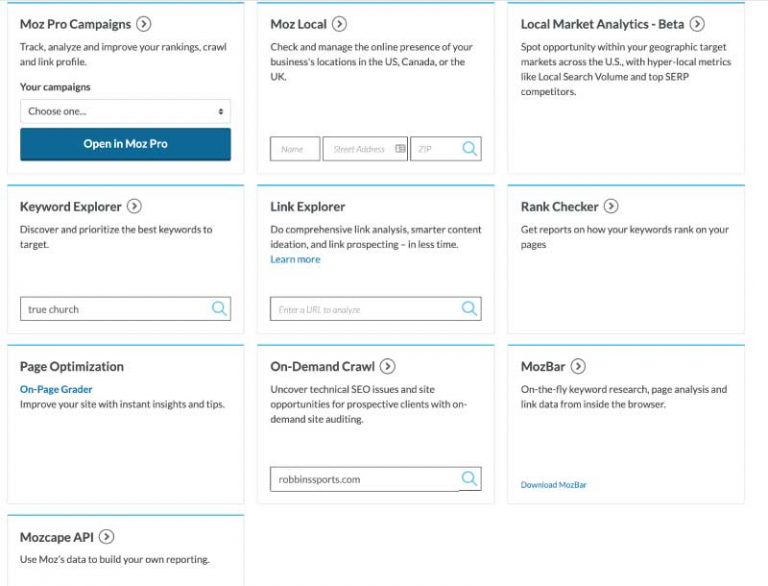

If you’re one who’s ready to jump out of the spending and debt cycle, or if you are just starting out on your financial journey and want to educate yourself on how to map your financial course using principles of financial prosperity, there is lots of help available. If you’ve ever listened to Dave Ramsey’s program on the radio, you know that he offers a nine lesson course on personal financial management called Financial Peace University. Financial Peace University (or FPU) costs $99 to attend the class, which includes nine lessons on financial management, access to an FPU class coordinator, a workbook, and the ability to be part of a local or online support community of like-minded people who are attempting to accomplish goals similar to yours.

By paying $129 per year to Dave Ramsey’s organization, you can get FPU extras, including an account with EveryDollar, the budgeting app designed to work with the FPU course, live stream feeds of Dave Ramsey’s events, financial coaching, and a couple other supplementary courses.

While Financial Peace University is probably the most popular one used by Americans to become financially literate, and while there are lot of others that you can use to accomplish similar results, did you know that there is a free course that’s available likely close to you that will provide you with an experience on par with FPU and other paid personal finance courses.

I’ll explain how the course works, and I’ll review the material that is covered in the course. If you’d like to take a look at the manual that comes with the course, you can pull up the PDF version of the course online.

LDS Church Personal Finance Self-Reliance Course

The Church of Jesus Christ of Latter-day Saints (also known as the LDS Church or Mormon Church) has built a reputation for promoting principles of thrift, industry, and self-reliance. The pamphlet One for the Money, Guide to Family Finance, which summarizes the core principles of financial management in families, has been published and distributed by the LDS Church since 1975.

In 2016, the LDS Church published a 12-week course designed to help individuals, couples, and families become more capable of avoiding debt, saving money, building wealth, investing, and being charitable. The approach taken by this course is one that presents the temporal concepts associated with managing money in context of the religious and spiritual underpinnings that ultimately serve as the basic foundation of everything else that we do in life. In fact, compared to Dave Ramsey’s Financial Peace University, the Personal Finance course that’s part of the LDS Church’s Self-Reliance curriculum (there are three other courses offered by the church, including ones that help with starting and growing a business, improving your education, and finding a better job) goes much deeper on the religious motivation for being a wise steward over your temporal possessions an opportunities.

If you’d like to participate in the Personal Finance course I’ll be discussing here, you can learn more about how the groups work by going to the church’s description of how group members participate. You can also contact your local LDS Church by entering your address into their meetinghouse locator to find a church close to you. The course is operating in what the church refers to as a “self-reliance group”, which is a fancy way of saying

If you need help finding a class to attend, feel free to contact me, and I can help you get connected with a group.

Although the religious aspects of this course are highly focused on the doctrines and teachings of The Church of Jesus Christ of Latter-day Saints, non-members of the church often take the courses and find benefit from the religious teachings in addition to the practical education and opportunity for financial accountability.

How LDS Self-Reliance Groups Function

This Personal Finance self-reliance course is normally operated within what are called by the LDS Church “self-reliance groups.” These groups consist of a person who’s called a “facilitator”, which means that he or she is responsible for organizing the group and being the point of contact person for the group. The facilitator isn’t necessarily a teacher, because the groups are intended to be operated by people whose input and interaction are intended to be equal and dynamic.

Self-reliance groups are formed on a regular basis. Even when they’re not scheduled to be formed, local LDS Church leaders monitor the need for people who want to participate, creating a new group and starting a new class on an on-demand basis.

When a self-reliance group is formed, the group goes through the 12-week program with the intention of changing the habits of group members and establishing improved patterns of managing their finances. A significant aspect of being part of the group is having an action partner and being accountable to that action partner for accomplishing goals and objectives throughout the week. The purpose of having an action partner is to motivate both people to complete what they each have committed to do.

Also, each of the members of the group is held accountable to the group for completing homework throughout the course. At the first of each group meeting, members of the group grade themselves on how well they kept their commitments from the previous week, and they share their successes and failures with the rest of the group as a means of receiving support and feedback they can use to help them do better throughout the next week.

Each of the 12 class sessions is expected to last two hours or less. In fact, the sections of each lesson provide for a timed review of principles and discussion so that the sessions don’t go too long.

As mentioned earlier, the personal finance class operated by the LDS Church focuses much more on the spiritual aspects of managing your money, sometimes using terminology that may not be as familiar to those who are not members of the church. However, this spiritual approach to such a temporal subject provides even deeper motivation for succeeding.

With that context, I will review each of the 12 individual lessons included in the course.

Becoming a Wise and Faithful Steward

In this section, members of the group are introduced to the concept of money and finances being an earthly stewardship. The parable of the talents as taught by Jesus Christ is used to convey the idea that God expects each of his children to be devoted to improving, including in the way that they earn money, use their money and other resources, and understand their obligation to be charitable.

This section introduces the importance of being thoughtful, prayerful, and counseling with God to receive guidance on how to be a better steward over managing income, expenses, and other aspects of temporal planning.

This section also introduces what’s called the Financial Stewardship Success Map, which is a visual depiction of religiously based financial concepts, which are portrayed together as a house built on three principles: faith in Jesus Christ, unity with spouse, and commitment to self-reliance.

The Financial Stewardship Success Map incorporates income (work) and spending (budget) and a progress chart that starts with paying tithing and offerings, a Judeo-Christian principle that comes with a promise of receiving the opening of “the windows of heaven” (see Malachi 3:10) and its associated financial benefits. The map then proceeds through topics similar to what’s found in Dave Ramsey’s Financial Peace University, including protecting your family from hardship with an emergency fund, savings for three to six months’ worth of expenditures, and securing adequate insurance. Next comes eliminating debt. Then there’s long-term saving money and investing. Finally, as a financially stable and even wealthy person, there’s the obligation to give back an help other people.

In this section of the course, there is an introduction to tracking expenses, which naturally becomes the first skill to be developed when starting on the journey to financial independence.

Becoming Unified In Our Approach to Finances

This section discusses the importance of families, couples, and individuals being unified in their efforts to manage their finances and become self-reliant. The overarching theme in this part of the course is that the process of becoming self-reliant through management of personal finances and related topics gets rid of entitlement and helps people overcome the negative consequences of the habit of relying upon others, including government programs, church, and even family members for personal financial needs.

In this part of the class, the objective is to get class members to be unified with loved ones, especially a spouse for those who are married, in tackling the issues that could prevent them from succeeding. Financial discord, wherein each individual in the couple relationship has a very different idea about how to manage (or not manage usually) finances, in a marriage is one of the major causes of unhappy homes.

The information contained in this chapter of the course manual is designed to help class members understand how to get their spouse, their children, or whoever they are most closely associated with on a day to day basis to be aligned with them in taking on the challenges involved with being a good steward over finances.

Paying Tithes and Offerings

The principle of paying tithing and giving other offerings, religiously based contributions to those who are less fortunate, dates back to the ancient Hebrews.

In this chapter of the Personal Finances course, the bridge between faith and taking care of temporal needs is built through the payment of tithes and offerings. The idea here is to demonstrate obedience to a God-given principle, with the expectation that you will be rewarded because of your commitment.

This is a principle that I and my family have learned over the years. Regardless of how well-off or not we have been, my wife and I have always been committed to paying tithing. As we have continued with that practice, we have seen blessings in our lives that have made us wonder where they came from and why they were given to us. We’ve been able to go from a poor, somewhat in-debt, newly-married couple to a station in which we’ve accumulated somewhat significant wealth, which allows us to give back even more.

Some may consider it strange that the payment of tithing and offerings is the first priority in the Financial Stewardship Success Map, but that’s not by accident. Ultimately, prioritizing faith above other things is expected to set a context for everything you do, and it acts as a way of humbly recognizing one’s dependence upon God for everything, spiritual and temporal.

Creating a Budget

In this section of the course, you learn how to create a budget. Similar to how FPU and other financial management programs do it, you’re encouraged to list out your expected income, your anticipated expenses (you’ve already begun tracking expenses in a previous class), and a goal for allocating money, including saving some, and paying off debt if you have it.

This class section allows you to start getting serious about changing habits. You are expected to find a mechanism, usually a program like EveryDollar or some other digital budgeting software, but it can be simply a physical budget ledger or journal, to start keeping track of income versus expenditures.

As you start budgeting, you begin to see areas where you are wasting money or not spending it according to what your vision is for your life. This class allows you to begin to fix that problem and hold yourself accountable to the other members of the class for doing so.

Sticking to a Budget

After initially creating a budget, many people find it difficult to maintain it. It’s likely that you’ve underestimated some costs or your ability to reduce those costs. It’s possible that your first shot at a budget turned out to be quite inaccurate.

In this section of the Personal Finances course, you learn how to iterate on your budget, fixing your estimates and doubling down on your commitment to be disciplined. Here you begin to develop your budgeting habits more completely as you’ve had some time to do trial and error on expense and income tracking and planning.

At this point in the course, you will be (if you haven’t already) figuring out a system for handling your budget. In the program that my wife and I attended, most people chose EveryDollar. Others decided to that spreadsheets fit their preferences better.

One of the benefits of this section of the course is the focus on setting and achieving realistic financial goals that keep you motivated to make some marginal, some major improvements to your overall well-being.

Having had a chance to dig into your budget and having set some financial goals for yourself and your family, you may have also found motivation to increase your income at this point. There are lots of different ways to earn more money, including doing some freelancer work or possibly working a part-time job outside of your full-time employment.

Regardless of what changes you’re making at this stage of the course, it’s encouraging to experience the empowerment that comes with trying, assessing, and trying again.

Protecting Your Family From Hardship

This section of the course focuses on putting in place means for keeping your family prepared to deal with any unforeseen situations that could set you back financially.

The two methods of protecting your family from hardship are these:

- Create a one-month emergency fund

- Purchase insurance appropriate for your situation

One-Month Emergency Fund

At this point in the course, you should have been tracking your expenses and planning a budget such that you understand what your expenses should look like for a month’s period. The next step in the course is to save (preferably into a separate bank account) enough to cover those expenses. This saved, set aside money is referred to as an emergency fund, and it allows you to handle unexpected events (like a car breaking down, a surprise visit to the doctor or hospital, or something else) without having to finance them with a credit card or some other more expensive method of payment.

Insurance

This aspect of protecting your family involves having property insurance, automobile insurance, disability and life insurance, health insurance, and any other type of insurance that you might need according to your lifestyle.

Property and automobile insurance protect your most financially valuable assets from loss in the event of a catastrophe. Considering that your belongings, including your house itself, can be worth tens of thousands of dollars or even more, property insurance allows you to not be susceptible to losing that value through misfortune. Automobile insurance specifically keeps you from being susceptible to a major financial setback in the highly possible event you are involved in a car crash.

Health insurance protects you from incurring the potentially high cost of needing medical treatment, which tends to get expensive very quickly.

Disability and life insurance protects your loved ones in the event that you, as the provider for the family, suffer a debilitating setback or untimely death such that you’re not able to provide for your family anymore.

Understanding how these various types of insurance work and making a good decision, getting adequate coverage without wasting money on plans that are overkill, is critical to your financial success.

This section of the course explains how insurance works, including explaining premiums (monthly payments) required to secure insurance coverage, deductibles (an amount of money that has to be paid for an insurance claim before the insurance company will pay its share), and how to do a cost-benefit analysis of an insurance plan.

Having a solid, updated education on how insurance works is critical for raising a family these days. Decisions you make in this aspect of your life often have impact on your life in the thousands, tens of thousands, and possibly more in the course of a year’s time.

Understanding Debt

This section of the program allows you to dig into how debt works so that you can clear up any debt you might have and avoid unnecessary debt in the future.

Counsel has been given to Latter-day Saints and to the world generally to avoid the crippling effect of debt. The leader of the church just over a decade ago, Gordon B. Hinckley, made this statement regarding debt:

[R]easonable debt for the purchase of an affordable home and perhaps for a few other necessary things is acceptable. But from where I sit, I see in a very vivid way the terrible tragedies of many who have unwisely borrowed for things they really do not need.

This class is designed to help you understand how debt works, how to avoid habits that cause you to get into debt, and commits you to get out of debt if you have any.

One of the most troubling social issues of our day is the tendency to be impulsive in our spending habits, thinking only about what’s happening now and satisfying temporary wants instead of looking at the long-term. This class allows you to do some self-reflection and understand your own impulsive and emotional spending habits so that you can become more disciplined about overcoming them.

Getting Out of Debt

In this section of the program, you reinforce the teachings from the previous class and establish a plan to get out of debt if you have it.

This class discusses the need to stop incurring debt through bad spending habits, and then extend yourself beyond stopping the damage from being done by repairing the damage that has been done through habits you’ve had in the past.

Developing a plan to get out of debt is described in these four steps:

- Decide to pay extra toward your debts.

- Decide where to pay extra.

- Use the rollover method.

- Take additional steps as needed.

In paying extra toward your debts, there are two strategies that are discussed: paying extra towards the debt with the highest interest rate, and paying down the debt with the largest balance. Both of these approaches are good ones, and each has its advantages and disadvantages compared to the other.

The rollover method involves taking the money you’ve been spending to pay off a debt and applying it to another debt once the first one is gone.

Getting out of debt is a struggle for the majority of Americans, who have been accustomed to car payments, student loans, buying gifts for Christmas and other occasions using credit cards, and generally getting what they want now at the expense of becoming a slave to their financial future. This section of the program should help you change your attitude towards debt and give you the motivation to, as Dave Ramsey often words it, “live like nobody else [disciplined in spending] so that in your future you can live like nobody else [debt free and wealthy]”.

When my wife and I took this Personal Finances course, we had no debt, including living in a paid-off house. However, we still felt very strongly that we benefitted from the classes that discussed understanding and eliminating debt, especially a certain degree of paradigm shifting regarding purchasing impulsively and without intention.

Managing Financial Crises

This section of the course prepares you to be more resilient against potential financial crises than what was expected during the Protect Your Family from Hardship class. In this class, you make plans to double down on an emergency fund, extending it to a 3-6 month plan.

This class also prepares you to respond in the event of a potential financial crises, including dealing with your insurance company, assessing your situation carefully and prayerfully, and making good decisions during a difficult time of your life, should that time arise.

Financial crises discussed in this class include losing a job unexpectedly, having a medical emergency, responding to a natural disaster, and other occurrences that could seriously jeopardize your financial security.

The LDS Church has for a long time been a strong advocate for emergency preparedness, including having a storage of food and other essentials that can be used to get through a difficult time, including situations where there is no income, food, power, medical attention, or other things available that we often take for granted. For more information outside of this class discussion on the topic of emergency preparedness, visit the LDS Church’s emergency preparedness resource site.

Investing for the Future (Part 1)

This section of the Personal Finances course discusses the fun part of self-reliance: living in abundance, and working to maintain that abundance through efforts that have you financially in the black.

Having gotten out of debt and started saving money, the next step is to start investing your money and time into things that will bring calculated returns on investment.

This class deals with creating a life’s mission and evaluating where you want your life to be in the years ahead. It encourages you to ponder what you’ll need to be able to achieve the vision you have for your life, including finding a mentor, getting an appropriate education required to achieve your goals, and going through the process of setting goals.

This section of the course invites you to consider home ownership, buying a reasonable home that increases in value, and paying off the mortgage as soon as possible.

Although investing as it’s most commonly thought of (putting money into stocks, mutual funds, and other retirement instruments) is not part of this chapter (those types of things are discussed in the next one), it’s useful to think about investing in terms of developing your skills and other aspects of your personality. Also, setting context for investing by considering what you want your future life to look like as a self-reliant person, couple, or family is highly useful for determining what financial instruments you might be interested in investing in.

Investing for the Future (Part 2)

This class follows up the previous one by helping you determine what you need to do to ultimately retire with enough financial ability to move on to the next phase of your life as one who has graduated from the ranks of the working class as you enter old age.

Concepts of the time value of money and compound interest are taught in this chapter. Also, evaluating risk and return on investment are considered.

The concepts taught in this section of the program help you make decisions about how to get involved in investments, considering investment principles like compound interest, risk versus return, fixed versus variable rates of return, and diversification. Also, tax implications of the various investments are brought up and discussed since that has such a significant effect on ultimately how much actual return on a financial investment is realized.

The ultimate objective of this class is to help a person or couple begin saving and investing for retirement, putting themselves in a situation to enjoy abundance such that they can provide more than adequately for their own lifestyle and goals, but also to give back and help others.

Continuing to Give and Bless Others

The last section of the LDS Church’s Personal Finance course addresses the spiritual need and obligation for those who have been fortunate enough to become self-reliant and to have their financials well-controlled to give back.

One of my favorite quotes that addresses this topic, the haves and their responsibilities towards the have-nots, is included in this section of the course. Marion G Romney, a leader of the LDS Church in the 1970s and 1980s, made this observation about becoming wealthy and using that wealth to bless others.

There is an interdependence between those who have and those who have not. The process of giving exalts the poor and humbles the rich. In the process, both are sanctified. The poor, released from the bondage and limitations of poverty, are enabled as free men to rise to their full potential, both temporally and spiritually. [Those who have more], by imparting of their surplus, participate in the eternal principle of giving. Once a person has been made whole, or self-reliant, he reaches out to aid others, and the cycle repeats itself.

I have seen this cycle of interdependence be a benefit to myself. I’ve never been in complete poverty, but I grew up in a large family in a fairly meager household where resources were often limited. Because of what I’ve learned growing up and since becoming an adult about self-reliance, I’ve been able to make use of the additional resources I’ve been blessed with to help my family and to help others who wouldn’t have otherwise would have been worse off.

My Experience with the LDS Personal Finances Self-Reliance Course

My wife and I attended this class together two years ago, spending two hours each Sunday together with a group of ten or so others.

The class was a great experience for us and for the others who took the course with us. Although my wife and I were already financially in a good position before we took the class, it was still highly valuable for us, especially since it helped us to get back into budgeting, a habit we hadn’t been doing for years, since our businesses started giving us a large enough income to not feel like we had to be careful about every dollar we spent. Taking this personal finance class helped us understand better than even when we’re in good financial shape, it’s important to have a stewardship mentality towards money and stay in the habit of spending intentionally, even if our spending is on what would fall more into the wants category than in the essential needs.

I highly recommend taking this course to both those who are struggling and looking for help financially as well as for those who are well on their way to retirement, Despite the fact that the underlying teachings are highly geared towards Latter-day Saint teachings, the course will benefit anyone who’s willing to have an open mind and who is religiously or spiritually inclined, since the course is based upon a spiritual foundation and not so much a strictly secular one.