Money Versus Currency

Most people tend to think of money and currency as being the same thing. If I have a $20 bill in US dollar currency, I understand that I can trade that bill in exchange for something that is $20 or less. I can buy $20 worth of gas (I’d have to prepay inside and have them credit $20 to a specific pump, as opposed to using a credit card, which works much differently from currency) at the gas station.

With a $20 bill in hand today, I can expect to be able to buy close to 20 dollar-priced trinkets from the dollar store (18 or 19 anyhow, depending upon what you end up paying in sales tax) , except for one small issue: inflation. Over the past several months, you may have noticed that the prices at your local dollar store are no longer $1. They are likely closer to $1.25 or so. Why is that? Because $1 is worth less now that it was last year, before the US Federal Reserve printed trillions more of the same kind of currency you hold, which made yours worth less. What you’re holding in your wallet, in your digital ledger at your bank in a checking or savings account, or in other forms of US currency is losing value. Ultimately, the USD currency will become worth nothing, just like all of the other fiat currencies that have existed before it.

Why is that? Because in any situation where an unlimited supply of something exists (or the ability to easily manufacture an unlimited supply), the laws of economics say that that thing ultimately becomes worth no more than the material it’s made out of.

Hopefully this helps you understand why currency, although for periods of time substituted for money, is not the equivalent of money.

In the video above, Mike Maloney describes money is an economic container for economic energy.

In economic terms, money is what allows people to trade their time and value for something else of value. Currency by itself has little to no value.

What is Money?

Money is most commonly defined as a medium of exchange. Money allows a person to pay for something he wants. Money is the means whereby business is transacted in a fluid way. Rather than a dentist having to find someone who needs dental work done in exchange for a car, the dentist gets paid with money for his services, and he can then use that money to purchase a car from a dealer or an individual who recognizes the value of the money he’s providing, whether it be in cash, using a personal check, a cashier’s check or money order, or even using a credit or debit card.

The most fundamental explanation of money is that it provides a convenient mechanism for people within a market to exchange goods for a commonly understood amount of value.

Digging into the reasons why money is used in societies, we find several aspects that characterize money. I will then explain the subtle but extremely important difference between money and currency.

Money is a Medium of Exchange

When you go to the store, you can exchange coins, $1 bills, $5 bills, $10 bills, etc. for what you want to purchase, which have prices. The most fundamental use of money is to allow its users to buy and sell, to trade.

Money is A Unit of Account

Because there are numbers associated with money (e.g. a quarter represents 25 cents; a $100 bill represents 100 USD), it is considered a unit of account. If you deposit 2 twenty-dollar bills into your bank account, your statement will show that you’ve added $40.00 to your own account.

Money is Portable

You can take money with you in a way that is convenient enough to allow you to exchange it with others. Otherwise, trade would be much more difficult, if not impossible.

Money is Durable

In order for it to be money, it must have a way of perpetuating. If money is made out of something that is easily destroyed, it loses its effectiveness and cannot ultimately be used as money.

Money is Divisible

To enable large and small transactions, and to allow users of money to make change when paid an amount of money that is above the asking price for a product or service, money must be divisible. There have to be units of money that are less valuable and others that are more valuable.

Money is Fungible (Interchangeable)

Money must be fungible, or interchangeable, meaning that it doesn’t matter which exact coin or bill I have, it can be exchanged for another one of equal value. A dollar bill is worth a dollar, regardless of whether it’s the one in the cashier’s drawer in the convenience store or the one in my wallet, or any of the others out there.

Money is a Store of Value (Long Term)

Money is a long-term store of value. In order for something to be truly considered money, it should have intrinsic value that doesn’t deteriorate or expire as time passes. It may fluctuate as supply and demand for the money fluctuate, but money should retain its purchasing ability.

Is Currency Money?

Currency (such as the USD and other fiat currencies) fails the Store of Value criteria test. Because governments are able to print more and more currency, the ultimate end of ALL FIAT CURRENCIES is to become worthless. Of the thousands of fiat (fiat means it’s not backed by a valuable commodity, such as gold or silver) currencies that have existed in the history of this world, none has survived. Most modern currencies are fiat.

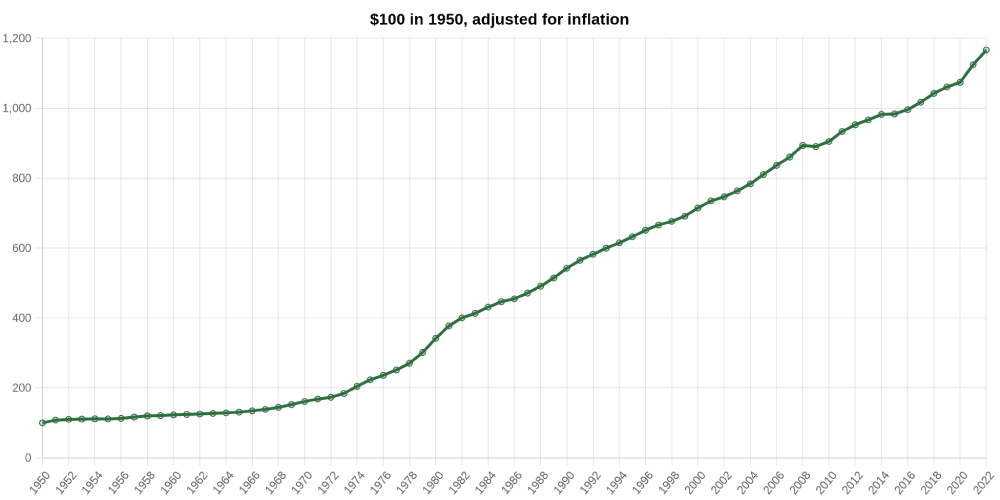

If you had a $100 bill in 1950, you could have purchased what is the equivalent of over $1,000 worth of goods in 2022.

That’s right, the value of our currency, the USD, has plummeted to 10% of what it was six decades ago. The chart below shows how that $100 has lost value since 1950.

In the past, currency has been nothing more than a claim check for the actual commodity that backed it, meaning that a $1 note could be redeemed for a defined amount of gold. The gold held the actual value. The currency was just a ticket to be redeemed for that value.

Why The Difference is Important

Understanding the difference between currency, which most of us hold in our wallets or in our bank accounts, and legitimate money is critical for making decisions about how to preserve your purchasing power. It is inevitable that the US dollar and other fiat currencies become worth zero. The United States has experienced periods of high or hyperinflation. In the 2020s, the likelihood of the dollar losing all of its value has become much higher. Other forms of storing money, including in traditional gold and silver forms as well as in new technology based cryptocurrency forms designed to be long-term stores of value, are vying for opportunities to replace currencies.

It will be interesting to see how the age-old principles of money make themselves known and out of control spending that is a natural result of building upon a fiat currency disrupt the trading system we’ve used for over a hundred years.