Chase Bank Profile

Chase Bank Summary

Chase Bank (part of JP Morgan Chase & Co.) is the largest bank in the United States in terms of assets. Chase has the second most branches (5,193) of any bank in the United States. Only Wells Fargo has more locations (5,930) than Chase.

Chase’s core banking products, like most other banks, include both personal and business checking accounts. It also offers basic, low-risk, low-interest savings accounts, where depositor’s savings are stored in CDs (certificates of deposit).

Chase also provides credit to account holders in the form of revolving credit, such as credit cards and home equity lines of credit (HELOC), as well as installment loans for buying a home (mortgages), a car, and lines of credit and loans for small businesses.

For investors, Chase offers several options, including self-direct investing using their online You Invest program, where you can educate yourself and choose the investment instruments you want to use. Chase also provides investment help through its network of in-house local investment advisors who work out of the various Chase branches.

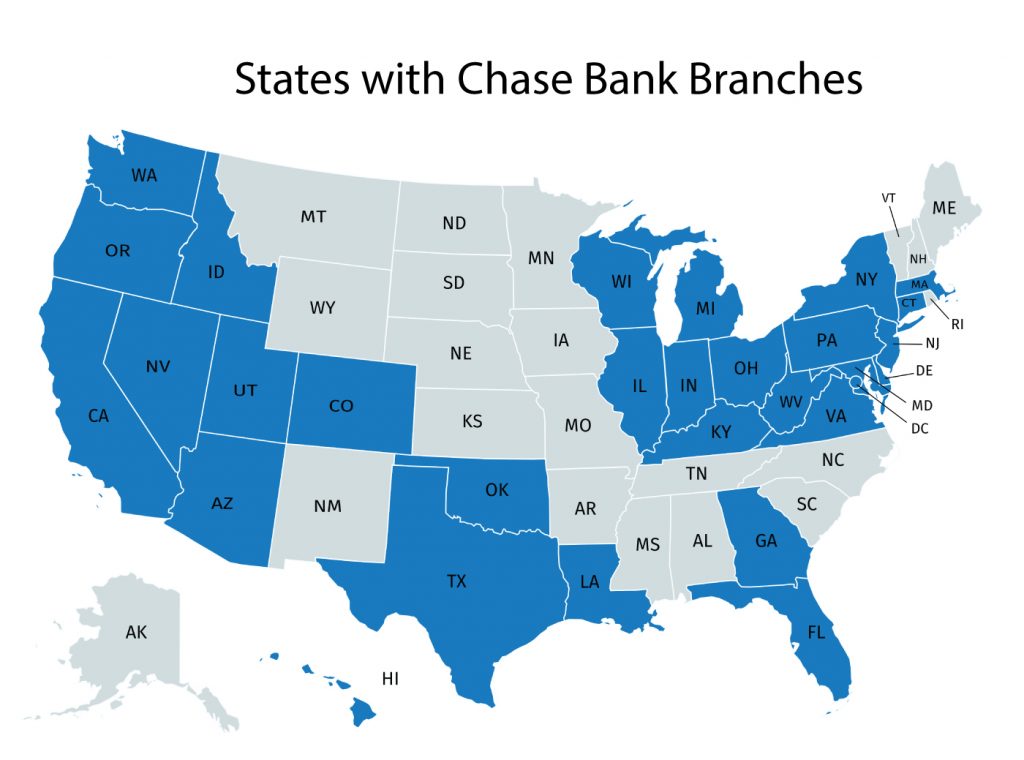

Chase Bank Locations

Chase’s 5,000-plus branch locations are spread throughout the United States, but (as you can see from the image below) there are significant gaps in Chase branch office coverage, including in two states in the West (Wyoming and New Mexico), several states the north central part of the country (Montana, North Dakota, South Dakota, Minnesota), in the Midwest (Iowa, Nebraska, Kansas, and Missouri), a few states in the Northeast (Maine, New Hampshire, Vermont, and Rhode Island), and in several states in the South (Arkansas, Tennessee, North Carolina, South Carolina, Mississippi, and Alabama). There are also no Chase branches in Alaska.

Where Do You Need Access to a Local Branch?

If you are planning to use Chase for day to day banking activities, it’s important to understand and plan for which local banking services you might need access to on a regular basis, including in the area you reside as well as where you might need access when traveling.

I found this out recently when I was surprised (after setting up accounts and using Chase for personal and business accounts for several years in Utah) to find that there was no Chase bank branch in the Nashville, Tennessee area. I needed to get a cashier’s check for a foreclosure auction I attended. Instead of getting a cashier’s check in Utah and hauling it across the country (which can be nerve-wracking, since remedying a lost cashier’s check can be complicated), I was hoping to stop by the local Chase branch in Nashville. But, since there are no Chase locations in all of Tennessee, I had to take a riskier approach.

Chase Bank Ratings

There are several websites that publish ratings of banks online. Below are some summaries of Chase Bank’s ratings published by a few of the most popular bank rating sites.

NerdWallet Editorial Staff (Overall Rating: 3.5 out of 5)

NerdWallet’s editorial team gives Chase bank a 3.5/5 star rating, citing pros that include its large network of branches and ATMs, the ease of avoiding a fee on Chase’s basic checking account (one of its most popular uses), and offers provided by Chase to open or deposit money into savings and checking accounts. Cons listed by NerdWallet include high monthly fees (in situations where you are obligated to pay them) and low interest rates on their savings and checking accounts.

NerdWallet Consumers (Overall Rating: 1.9 out of 5)

NerdWallet users were not so kind in their reviews of Chase, with their collective rating at a 1.9/5.

ConsumerAffairs: (Overall Rating: 1.5 out of 5)

ConsumarAffairs users rate Chase Bank poorly, with an overall score of 1.5 out of 5. The complaints listed there range from overdraft fees to poor customer service to a website redesign that is hard to follow.

While Consumer Reports doesn’t give a specific score in their assessment of Chase, they did report that in their survey of 72,000 Consumer Reports members, Chase had a higher customer satisfaction rating than both Bank of America and Wells Fargo. In the same article, Consumer Reports summarizes that smaller bank institutions generally scored higher than nationwide ones like Chase.

My Own Experience with Chase Bank

I have been a customer of Chase Bank since 2015, including having personal and business checking and savings accounts, and some investment accounts there. I’m actually in the process of shopping around for another banks for a number of reasons.

I originally moved several of my accounts to Chase because my local bank (Bank of American Fork in Utah) was consistently rejecting wire transfer payments from customers I had outside of the United States. Also, Bank of American Fork charged a fee of $35 per wire transfer going out, and $10 per incoming wire transfer. I needed a bigger, national bank that could accept payments that smaller local banks (at least the one I was using) apparently struggle with.

I was initially impressed with Chase when my wife and I went to set up new accounts and transferred nearly $100,000 into them from our Bank of American Fork accounts. Besides checking and savings accounts, we set up a couple credit cards for personal and business uses. Our transfer of assets from Bank of American Fork to Chase resulted in a net of over $1,000 in perks.

Soon after we set up our accounts at Chase, we were approached about becoming private clients, which would involve moving retirement accounts from AXA. We were told that private clients get white glove service. At the time we were planning to move out of the country, and we were sold on the idea that Chase’s dedicated phone number for private clients was the best way to get priority customer service.

When we set up our Chase accounts, our account rep was highly knowledgeable and very responsive.

Over time, the honeymoon with Chase has worn off, although I would still recommend them for lots of people. Here are some of the concerns we’ve had as we’ve banked with Chase over the past few years.

Lack of Customer Service: We found it next to impossible to reach someone at the local branch and via the private client line. That lack of customer service proved to be very frustrating, especially since there were some things set up incorrectly with our account that made it difficult for us to access our money while we were out of the country in Costa Rica. Even our local Chase representatives had difficulty getting help from the corporate support team, both when we were in the local office attempting to get things done as well as when we called in remotely.

After experiencing a few somewhat urgent situations during which we couldn’t get in touch with anyone to help us, our friendly account manager gave us his direct number and promised to be responsive. During the time he was our account manager, he was responsive. But recently he moved to a different position with Chase, and that responsiveness went with him. The other two involved in helping us set up our private client (VIP) account are also gone, which makes it feel like a lot of the energy we were greeted with once upon a time is now gone.

In the past several months, even when my wife and I have had appointments with account representatives, there have been times when we have waited for a half hour before having to leave with our matter still unresolved.

Sloppiness: Within the past year, some fraudulent (or potentially simply mistaken) checks were written from one of our checking accounts. When we reported it and it was investigated, it was assumed that one of the tellers accidentally gave another local customer (the checks were written to and deposited by a company within 20 minutes of our house) some counter checks that were attached to our checking account.

It was a bit of a hassle to close down that account over the ensuing month or two, and there were payments (including from our monthly Chase card balance) that bounced. Chase has been good about crediting late fees and interest in that case, but the sloppiness has taken some time and energy to correct.

Social Activism: Last June as I was using the ATM at my local Chase location, the transaction ending screen popped a message supporting LGBT Pride Month. The message was an assumption that everyone believes (or should believe) in that agenda. Like the majority of Christians, I personally am strongly opposed to the promotion of homosexuality and other behavior that I consider to be sinful and detrimental to individuals and to society generally. I found out, by calling Wells Fargo and looking into the social views of other banks, that national banks appear to be “required” to go along with that narrative, which makes most of their social positions opposite of mine and other Christians.

“Nationwide” Has Its Limits: I mentioned earlier that although Chase has over 5,000 locations, there are some parts of the country where Chase is not accessible, including in Tennessee, where I’m planning to move my family soon. I will need to change banks for that reason alone. For anyone who needs access to a branch in any of the 21 states where Chase doesn’t have a local presence, having your daily financial needs serviced by a bank account with Chase obviously won’t work.

Chase Bank Pros: As with most companies, even though Chase’s corporate commitment to customer service seems lacking, there are some helpful, friendly people we’ve encountered in our local branch.

Also, we’ve been please with the promotional offers provided by Chase to sign up for credit cards (which we needed for newly opened businesses anyhow) and for checking and savings accounts.

Current Status: My family and my businesses still use Chase for several accounts that have well over $100,000 (which seems to be their threshold for treating you like you’re important) in value, but we will be moving our accounts soon for some of the reasons stated above. If we weren’t moving to a state where there is no Chase branch, we might leave some of the accounts where they are, but it’s convenient for us to make a complete switch instead.

Conclusion

Like most large companies, Chase has its strong points as well as its weak ones. It struggles with customer service issues, but if you learn how to work within your system, you can make it work. Also, before committing to being a Chase customer, you should make sure that their location map works for your needs.

Chase bank employees are rude they have zero people skills totally unprofessional. My auto loam was behind and chase bank had a wrong address plus a wrong phone number for me. They ssid they reached out to me which was a lie, they didnt have address right or phone number. I had money to catch up loan they refused to take it. They were so rude and unprofessional, one person even hung up. I had a similar situation with US bank they we understanding they even set up a payment regiment to get back on track they were very respectful and understanding. Chase bank could take some lessons from US bank.