High Interest Online Savings Accounts

Saving money is a good idea.

Saving money in a way that allows it to grow and create more money through interest is a better idea. Opportunities to increase the rate at which interest is being earned with your saved money (without increasing your risk to losing that money) are worth giving some attention.

High interest online savings accounts provide much higher interest rates than traditional savings accounts that are usually set up at through local bank and credit union branches. For those who have a significant amount of savings, the additional income from setting up and maintaining a high interest savings account over putting your money into a brick and mortar bank account can be substantial, as much as twenty times what you’d be getting with the traditional alternatives.

Are You a Saver? Congratulations!

According to a 2017 study published by Career Builder the large majority of Americans (over 75%) live paycheck to paycheck. For any individual, there is lots that can be done to change that situation personally, including following any of the proven systems to get out of debt and save money.

For those who have learned to be disciplined and have set aside some portion of your income for saving and investing, it’s important to know what options are available to put that money to work. In this article, I’m going to talk about high interest online savings accounts. I’ll share with you the details of how online savings accounts work and how they compare to other investment alternatives.

Why Online Savings Accounts Have Higher Interest Rates

Put simply, online savings accounts can provide higher interest rates for account owners because they don’t have the overhead costs, including wages paid to tellers and other employees, expenses associated with operating physical buildings in prime retail areas, and the other costs associated with running a retail banking establishment.

Because the companies that operate online savings plans don’t have the operational costs that traditional brick and mortar banks have, they are able to offer much higher interest rates on the money you deposit into your account while still remaining profitable.

Are Online Savings Accounts Risky or Secure?

Online savings accounts involve security that put them on par with brick-and-mortar financial institutions. Transactions conducted online are done with internet security and encryption that is similar to what you’d experience using a local bank’s web portal to interact with your account.

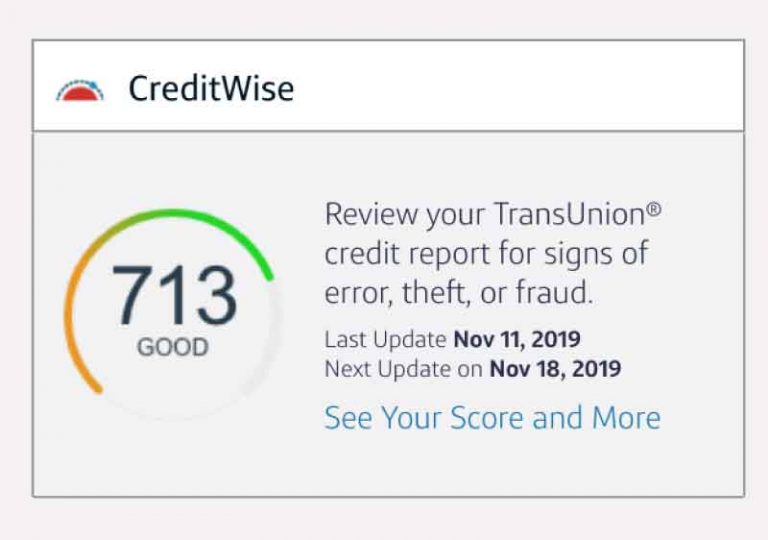

Online savings accounts are FDIC insured, similar to traditional banks. Standard FDIC insurance provides $250,000 worth of deposit insurance coverage per deposit account. Wealthfront, the savings institution I use, insures accounts up to $1 million of deposits in savings accounts.

What Determines the Interest Rate?

Interest rates for online savings accounts are determined by several factors in consideration of the business’ overall mission to make a profit. Companies that offer online savings accounts borrow your money and pay you a low enough rate that they can lend out your money at a higher rate, giving them a margin on your investment so that they can make money.

The primary factor in determining the interest rate for online savings accounts is the rate set by the Federal Reserve, or the “Fed rate.” This rate is the interest rate at which banks lend money to each other, and it highly influences interest rates at banks, including the rate at which banks are willing to lend money and the rate at which they’re willing to pay you to save your money at their institution.

I recently received this message in an email from Wealthfront, where I opened an online savings account several months ago.

Because of the Fed’s decision to decrease interest rates, the interest rate on your Wealthfront Cash Account is changing from 2.32% APY to 2.07% APY beginning today.

In that same email, Wealthfront linked to an article they published on their blog that gives much more detail about how the federal funds rate affects the savings rate they offer ti

As you can see, the savings rate among online savings accounts can be volatile, and is most influenced by changes in the Fed rate.

There are obviously other factors that play into the interest rate you’ll receive from your online savings account. This is evident by the fact that there exists such a range of interest rates offered by the various online savings institutions. Operational costs, competition, and executive approach to banking also factor into the rate offered by an online savings account.

BankRate.com publishes an updated list of the highest savings rates. It’s common that, even though the rates often change as discussed above, normally the best rates are offered by the same group of 5-10 companies.

Other factors to consider besides savings account, which is usually the most important factor, are conveniences such as whether there are ATMs available from the institution for retrieving money, how many monthly withdrawal transactions are allowed, and any other functional needs you might have related to having a savings account for which there is not local bank.

What Situations Merit Opening a High Yield Online Savings Account?

If you have extra cash available, it might be worth considering whether a high interests online savings account is a good fit for you.

Whether and how much to put into an online savings account is subject to your investment goals, the alternatives you might have, how soon and how often you need access to your savings money, and other factors.

The reason I opened my online savings account was having some cash available from selling my home. I didn’t want to leave the money in an account that netted a negligible amount, but I also wanted to be able to use the cash for potentially paying off credit card statements or to pull it out to pay for a new home.

Having cash in a high yield online savings account is a good idea when you want to diversify your investment portfolio with something that is conservative, like cash in a traditional bank, but you don’t like the thought of missing out on a higher rate of return than what your local bank can offer.

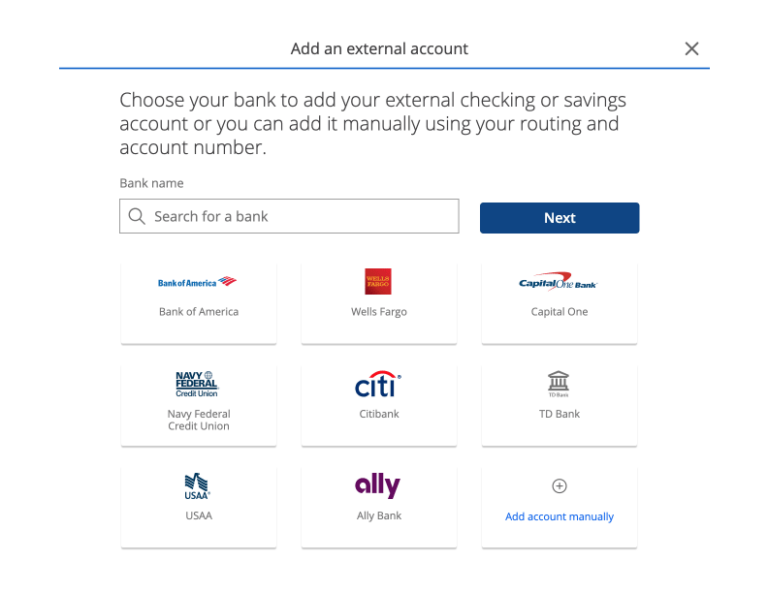

Where and How to Open an Online Savings Account

There are so many institutions offering online savings that it can take some research to find the best one for your purposes.

Below is a list of the most popular places to open an online savings account. As of the time of this writing, the interest rates for these savings account range from around 1.5% APY to just over 2.0%. If you’re shopping just for interest rate, HSBC and Vio Bank are currently the best options. If there are other features of the account, whether it be a minimum balance to open the account, ATM access, customer service availability, or other important aspects of your account, you’d be best served to do some homework.

With that said, here are some of the most popular places to open an online savings account.