Debt

Rather go to bed without dinner than to rise in debt.

Benjamin Franklin

Debt is having a crippling effect on too many American households. With the trends towards materialism and a credit-based society, it’s nice to have some sound advice and useful education about how to avoid debt, how to get rid of debt, and ultimately how to free oneself from the bondage that is created from a lack of discipline when it comes to spending.

This section of Prosperopedia.com is dedicated to providing news, tips, and useful information about debt management, including how to get yourself out of debt, how to properly use debt in the right situation (think mortgage for a home, financing a business…and little else), and how to teach your kids and others the principles that will help them avoid the pitfalls of spending more than they earn.

We hope you enjoy reading and interacting with the content you find here.

National Debt Relief is an affiliate of Prosperopedia.com. If you feel like you could use some help getting out of debt, click the banner below to learn more about how their debt reduction program works.

Debt Service Coverage Ratio (DSCR)

In the world of finance and investment, understanding key financial ratios is essential for sound decision-making. Financial ratios offer valuable insights into a company’s profitability, liquidity, solvency, and overall financial health. They serve as critical tools for lenders, investors, and financial analysts, allowing them to make informed decisions based on quantitative data. One such crucial…

How Credit Cards Work

How do credit cards work? Learn how to own and manage credit card ownership responsibly

How To Update Your Capital One Credit Card Billing Address

If you’re having problems with your Capital One credit card being declined, and if you’ve moved recently, your problem may very well be that you’re using a zip code (your old one) that’s not connected with your Capital One credit card. When you use a credit card at a gas station or in other places…

Even You Can Debt Free

A couple years ago I finally got out of debt. I was thrilled! I shared my story with others and I was really surprised as most of those I shared it with congratulated me, but shared the sentiment that they would not be able to become debt free themselves. I was sad that these people…

Mistakes That Cost Me Years of Debt

When I graduated from high school I was determined to be good with my money, to avoid unnecessary debt. I was NOT going to get a credit card and planned to work to get myself through college. Unfortunately I graduated from college 5 years later with about $45,000 of student loans and 6,000. It wasn’t…

Dave Ramsey’s Financial Peace University

If you listen to talk radio much, you’ve most likely heard of Dave Ramsey, the radio personality who talks about money, debt, budgeting, investments, and related topics Monday through Friday each week. His show is broadcast on over 500 radio stations throughout the country to an estimated audience of over 6 million people on a…

LDS Personal Finances Self-Reliance Budgeting Course

Taking control of your personal finances is one the most important things you can do to experience the blessings of prosperity that are available to those who are willing to obey the principles upon which those blessings are based. Under the influence and in the grasp of the materialistic society in which we now exist,…

Trump’s Healthcare Pricing Transparency Executive Order

My wife recently gave birth to our seventh child. Just a few months before he was born, we moved from Utah to Tennessee. Our plan was to have the delivery done by a group of midwives at a birthing center close to Vanderbilt University, but those plans were changed by the birthing center midwives just…

Contracted Earnings Signs of US Recession

Going into 2020, the United States economy has experienced the longest period of economic expansion in its history. After the Great Recession of 2007-2009, we’ve seen growth starting in June of 2009, a period that has lasted more than ten and a half years. According to the National Bureau of Economic Research, the average period…

Fanny Mae Form 1003 Uniform Residential Loan Application

If you’re applying for a mortgage loan or have applied for one in the past, you’ve possibly heard of Fannie Mae Form 1003, Uniform Residential Loan Application. Form 1003 is the standard form used by most mortgage lenders to collection the information of a potential borrower necessary to determine whether the applicant is qualified to…

The Mormon Church’s Financial Responsibility Should Be Emulated, Not Criticized

Recently there has been a lot of buzz about how much money the Mormon Church has in its possession after an accusation came out from former church members and twin brothers David and Lars Nielsen. David was a former employee of church-owned investment firm Ensign Peak Advisors. The claim from the Nielsens is that the…

Public Service Loan Forgiveness (PSLF) Program

Article Summary The Public Service Loan Forgiveness (PSLF) program was established by the federal government to allow professionals to have their student loan debt forgiven. Participating in the PSLF program requires you to work for a qualified employer as specified by the US Department of Eduction. Qualified employers include government and non-profit organizations. Only Direct…

National Debt Relief Program and Services

Article Summary National Debt Relief is a New York City-based debt relief company founded in 2009 that helps clients throughout the United States reduce their unsecured debt burden through a program that includes services such as negotiating with creditors to lower the amount owed, consolidating debt and reducing the amount of interest being paid, helping…

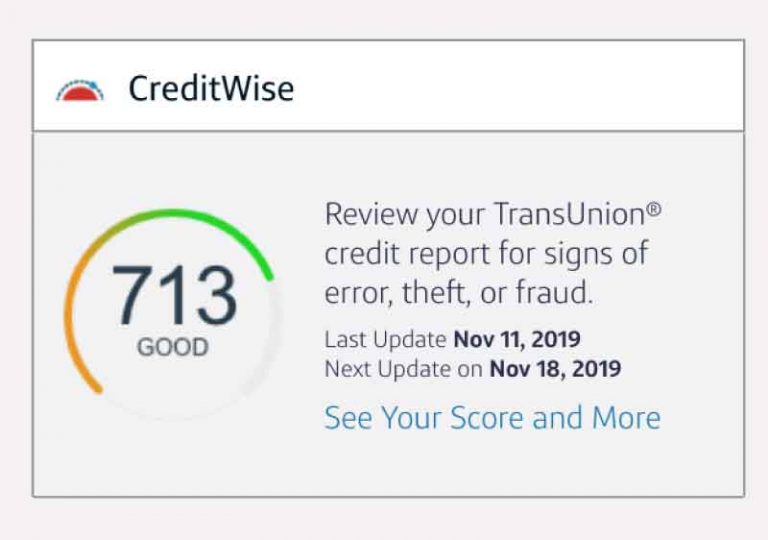

CapitalOne Creditwise Free VantageScore Credit Report from TransUnion

Article Summary CapitalOne provides free credit scores for credit card holders through their CreditWise monitoring product. When you sign up for a credit card with CapitalOne, you get access to CreditWise as a free add-on service. CreditWise uses TransUnion data to provide CapitalOne credit card holders with a credit score calculated using the VantageScore 3.0…

What is a Mortgage?

Making good decisions about the home that you purchase to live in (or as an investment) is critical for being prosperous and building your financial wealth. To help you make better decisions with regard to how you’ll finance your home or another property, this article covers the essentials of how mortgages, not only answering the…

Can a Section 609 Dispute Letter Repair Your Credit?

People always seem to be looking for shortcuts to getting what they want. While it’s certainly true that there are more effective and efficient ways of accomplishing something as well as less efficient and less effective methods, easy shortcuts typically don’t produce what most people hope they would. This principle applies to the 609 Dispute…

How to Get Out of Debt

If you have substantial debt, you’re much like the average American, who carries a personal debt load of about $30,000. That number doesn’t even include a mortgage, which is usually considered a good kind of debt. Instead, that $30,000 average debt load (as reported by Northwestern Mutual’s 2019 Planning and Progress Study) on Americans consists…

Wells Fargo Debt-to-Income (DTI) Guidelines and Recommendations

Wells Fargo is one of the largest lenders in the United States, one of the biggest banking institutions in the world. They offer all sorts of loans ranging from traditional home purchase mortgages to student loans, personal loans, auto loans, and business loans. Wells Fargo knows a thing or two about lending, including what causes…

How to Cancel Your Audible Account

Audible, the world’s leading platform for distributing audiobooks and other spoken audio entertainment, is great for a lot of things. In my household, my wife and kids and I use Audible almost every day for entertainment or to educate ourselves on one topic or another. In spite of how much positive I have to say…

What Factors Affect Your Credit Score?

Credit Reporting Agencies and FICO Score Understanding how significantly your credit score affects your access to borrow money, you naturally want to know what factors affect your credit score. I will answer that question for you, and I’ll provide other details related to credit scores that should help you make good financial decisions as you…

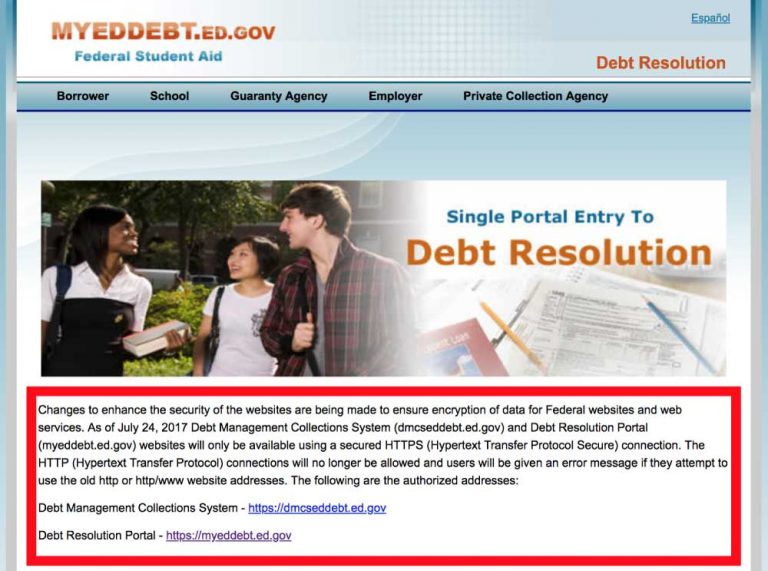

MyEdDebt.gov Debt Resolution Portal for Defaulted Student Loans and Grants

Student loan debt is having a crushing effect on current students and graduates, whose college dreams often have turned into nightmares as they realize that the job and career for which their specific degree has prepared them is likely not worth the cost of obtaining it. There are over one million people each year who…

One for the Money, Guide to Family Finance

If you want to be successful raising a family, one of the most important skills you can develop is managing your finances. In the 21st Century, being a parent is more expensive than ever. A USDA report released in 2017 estimated that it will cost parents $233,610 to raise a child born in 2015. In…

How to Become a Millionaire

I’m going to share with you the formula I’ve followed to become (together with my wife) a millionaire. But first, some context. The United States has more than 11 million households reporting a net worth of more than 1 million dollars based on the latest Spectrem Group Market Insights Report. That number represents about 8…

Getting a Home Loan with Bad Credit

One of the primary factors lenders consider when you apply for a mortgage is your credit score. They normally use what’s called a FICO score, which is a number that ranges between 300 and 850. Lenders use this number to assess your trustworthiness, as it represents your recent and extended credit history. How you have…

Dave Ramsey’s 7 Baby Steps for Saving Money, Paying Off Debt, and Building Wealth

Dave Ramsey is a popular radio show host, an author of several books about financial management and developing life skills. Besides being a great teacher, he is also, not coincidentally, a successful businessman and a devout Christian. His Financial Peace University course has been completed by over 4 million people. Ramsey’s formalized and systemized financial…

How Much Home Can I Afford?

When you’re shopping for a home, one of the very first questions you’ll ask yourself is, “How much home can I afford?” I’ll answer that question for you in this article using the information lenders use to qualify you for a loan amount as well as some recommendations based upon my own experience buying homes….

FHA Loan Debt to Income (DTI) Ratio Guidelines

FHA Loan Debt to Income (DTI) Ratio Guidelines FHA loans allow first time home buyers and others who are just starting out or who may be financially disadvantaged to purchase homes through a government assisted program that differs from conventional loans. To qualify for an FHA loan, the Federal Housing Authority requires that you meet…

Don’t Buy Stuff You Cannot Afford

The Simplest Financial Management and Debt Reduction Plan Ever The materialistic, super-indulgent world we experience today has created a very large demand for debt reduction programs, debt counseling careers, thousands of apps for managing personal and family finances, and a thriving market where millions of people make lots of money selling products to people who…

How To Become Rich – The Richest Man in Babylon Formula

The Richest Man In Babylon is a fictional story with sound principles that have helped people become wealthy through their application. This first part comes from the part of the book “Seven Curses For A Lean Purse”. Heed the advice in each of these sections, and your “purse” will become fat and overflowing with wealth….

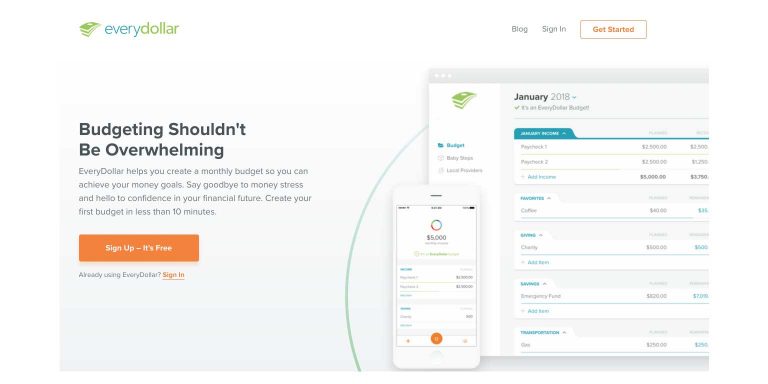

EveryDollar – The Free Budgeting App from Dave Ramsey

EveryDollar is a budgeting application that is used by millions of people and families to keep track of how they spend their money and to do other budgeting activities. The EveryDollar app is a comprehensive monthly budgeting tool, allowing users to enter and track income and expenses on a monthly basis so that they can…