What Factors Affect Your Credit Score?

Credit Reporting Agencies and FICO Score

Understanding how significantly your credit score affects your access to borrow money, you naturally want to know what factors affect your credit score. I will answer that question for you, and I’ll provide other details related to credit scores that should help you make good financial decisions as you understand what things make you a bigger risk to lenders, and what things make you a safer bet.

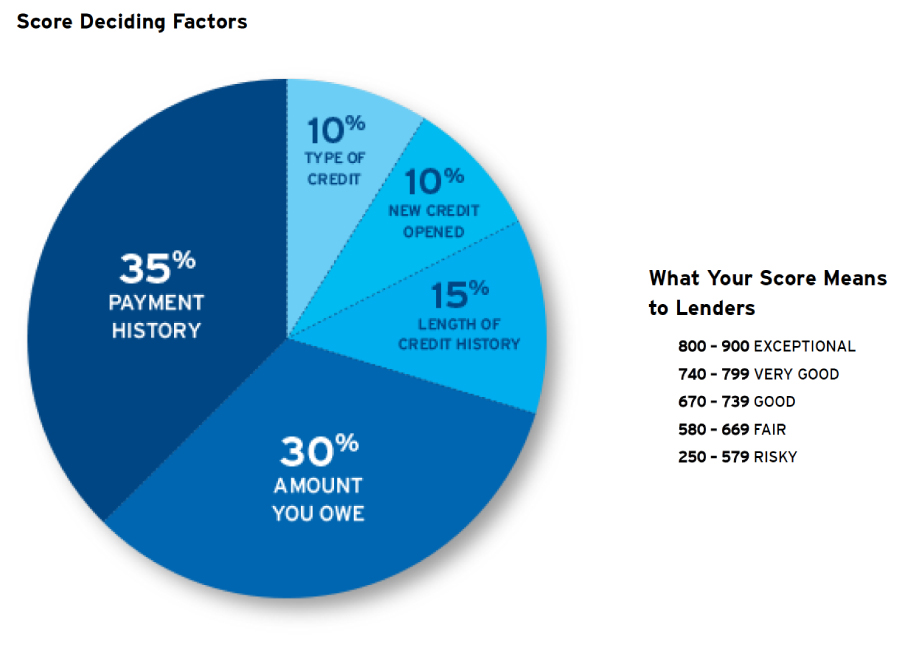

FICO scores are calculated from these components:

- 35% Payment History

- 30% Amount You Owe

- 15% Length of Credit History

- 10% New Credit Opened

- 10% Type of Credit

There are three major credit reporting agencies who are used by lenders, credit card issuers, and others to evaluate the risk associated with a potential borrower. The three major credit agencies are: Equifax, Experian, and TransUnion. Credit reporting criteria and calculations vary among the three. TransUnion produces a numerical credit assessment referred to as a VantageScore. Equifax and Experian credit scores are usually similar. Their credit scoring systems produce a FICO score. The FICO score is most commonly used among lenders.

People’s individual credit scores have a significant impact on their financial well-being. Credit scores are measures of your financial responsibility. If you’re credit score is high, it can mean more opportunities for financial tools like credit cards with higher limits, a mortgage with a lower interest rate, and other important benefits. If your credit score is low, you may not qualify for a mortgage, for a car loan, or for a credit card you may want, or, your interest rate for borrowing will be higher than those who have good or excellent credit.

This article uses the components of a FICO score to evaluate what factors affect your credit score.

Most FICO scoring systems range from 300 up to 850, but there are some industry-specific scoring models that use a larger range, going from 250 to 900.

On-Time Payments – 35%

The On-time Payments component of your credit report contributes 35% of your overall score.

The highest impact factor on your credit score considers how well you keep up with payments that you are obligated to make on money that you’ve borrowed or credit that’s been extended to you. Your payment history is typically comprised of records and status of payments made on student loans, credit cards, car loans, home loans (including mortgages and home equity lines of credit or HELOCs), and other situations where you have borrowed money from an official lending or finance institution.

Rent, utility bills, cable and internet bills, cell phone bills, and other similar financial obligations common to the general population don’t show up in a way that positively affects your credit score. Only when those bills are unpaid, especially when they are behind enough to a collection agency, do they affect your credit score. If you are one payment late on one of those bills, it will not normally not be reported and won’t hurt your score. In those instances, you can usually get caught up without it appearing anywhere on your credit report.

The easiest way to boost this score factor is to make sure that you’re paying your bills on time. If you have an emergency or some other reason that causes you to anticipate not being able to pay all of your obligations, it’s wise to contact those you owe and let them know your circumstance. In many instances, creditors are willing to cooperate and be somewhat accommodating.

If you’re getting behind on payments and finding yourself frequently having to pay late fees and minimum payments to get by, it’s time for you to get control of your spending habits. There are several useful programs available through churches and other institutions that will help you get on track, including setting up a budget, earning more, and spending your money with more intention, aligning it with your personal life mission instead of spending impulsively and recklessly. You might try out Dave Ramsey’s Financial Peace University program and get started with his 7 Baby Steps for taking control of your finances.

Amount You Owe – 30%

This part of your credit score evaluates how much money you owe on each of your credit balances as well as the total amount you owe across the types of accounts listed above, including credit cards, car loans, student loans, home loans, and other credit given from a lending or financial institution.

The ultimate calculation of this credit score factor varies depending upon individual circumstances. For instance, I am involved with several businesses, many of which use credit cards that I opened for them. We tend to spend a lot of money paying suppliers for the products we sell, which is a good thing. In any given month, we may owe more than $100,000 in total across the various credit cards I carry. However, each month, the entire balance from the previous month is paid off.

Some of the components of this Amount You Owe credit score factor include:

- How much you owe across all open accounts

- How much you owe broken down by different types of accounts; some types of high balances are considered higher risk than others

- What percentage of your available credit you’re using

- The number of different accounts that have balances; more accounts with balances signifies higher risk

- A comparison of the total amount left on installment loans versus the original amount borrowed

To improve this Amount You Owe element of your credit score, you can pay off balances or pay them down as much as your savings reasonably allows, close one of your credit cards (the most recently opened is best) if you have several.

Length of Credit History – 15%

FICO scores consider how much experience you’ve had with credit being extended to you by looking at your credit history. The longer you’ve had credit extended to you, the higher this element of your score will be.

For younger people, this factor is harder to manage. FICO scores look at the length of time you’ve been given credit. For this reason, many financial advisers encourage people to open a credit card account (usually with a small credit limit) as soon as they become adults. However, you have to be careful with this reasoning. As many debt counselors advise, it’s a bad habit to start out as an adult spending on credit without being disciplined about a budget and having money to pay off any amount you put on a credit card.

To improve the Length of Credit History factor of your FICO score, it’s advisable to keep open some sort of credit account long-term.

One trick that’s been used successfully by people who are lacking in the Length of Credit History area is to have themselves added as an authorized user on a credit card that has a long history of being opened.

New Credit Opened – 10%

Opening too many new credit lines too quickly can cause your FICO score to do down. Even for those with longer credit histories, opening more than two credit cards in one year (I have experience with the effects of this) will likely cause a drop in your credit score based on the New Credit Opened component.

Credit inquiries are part of the New Credit Opened component of a FICO score. There are two different types of credit inquiries. One is called a soft inquiry (or soft pull). The other is a hard inquiry (or hard pull). Soft inquiries don’t negatively affect this part of your credit score, but hard inquiries (several of them in a short period of time) will.

Soft Inquiries

Soft inquiries are done for things such as when credit card issuers make pre-qualified offers or when an employer checks your credit before hiring you.

Sometimes a lender will do a soft pull as a part of pre-qualifying you for a loan. That soft pull will later be followed up with a hard pull as part of the vetting process before the final loan is approved.

Soft inquiries are ones that are often made without your specific request or knowledge.

Hard Inquiries

Hard inquiries are done when you specifically request credit from a bank, a credit card issuer, or other lender. You give these institutions authorization to do a hard pull of your full credit report so they can make an informed decision about whether to extend credit to you.

Having too many hard inquiries on your credit report will lower your score. To avoid having a negative impact on your score, I’d suggest as a general rule two or less applications for credit (credit card, mortgage, ) per year. However, there are times when you need more credit extended, maybe as part of your business expansion or in cases such as when you’re working through a real estate investment strategy and need credit.

As I mentioned before, if you’re interested in keeping your credit score high, you have to be careful opening too many accounts too quickly. You’re typically looking at a one-year period being considered by the FICO calculations.

Although hard credit inquiries normally stay listed on your credit report for two years, according to their explanations about the effects of hard credit pulls by both Experian and Equifax, hard inquiries only affect your FICO score for 12 months after they’ve been made.

In one year period I opened three new accounts – two credit cards and a home equity line of credit – for business and for investment purposes, and I saw my credit score (still considered good) drop by close to 40 points.

Type of Credit – 10%

Credit is grouped into two major categories, revolving credit and installment credit, and those groups also contain sub-categorizations that are considered by the FICO scoring system. Having what’s considered by the lending industry a healthy balance of some number of the available credit offerings – credit cards, retail accounts, installment loans, car loans, mortgage loans – will improve this element of your score.

Revolving Credit

Revolving credit includes things like credit cards, retail store cards, and similar financial instruments. With revolving credit accounts, the account is not automatically closed when the balance reaches zero. Instead, there is a credit limit provided to a consumer, who uses none, some or up to all of that credit limit depending upon needs.

Although it works in some ways similar to a mortgage, a home equity line of credit (HELOC) is considered a revolving credit account.

Installment Accounts

Installment accounts include loans and similar financial arrangements where a net amount has been given as a loan for a specific purpose – to purchase a house or finance a car, an education, or for some other reason – and that amount is paid back over a period of time. With installment accounts, there is often some sort of collateral involved, which allows installment providers to extend much higher amounts of credit.

The Perfect Credit Score

Is it possible to have a perfect credit score? Technically, yes. Feasibly, not really.

There are diminishing returns for getting your FICO score up to 850 on the scale. It likely means getting loans you don’t need and wasting money on interest. Unless you’re just one of those people who aced the ACT or who has “Obtain a perfect FICO score” on your bucket list, I don’t recommend it.

If you are interested in at least knowing what it takes to get a perfect credit score, you can refer to Ask Abby’s step-by-step guide to achieving a perfect FICO score. If you’d rather watch the video where they describe the steps, you can see that below, beside this summary…

Achieving a perfect credit score according to Ask Abby involves:

- staying in the 0-9% credit card utilization range. Paying off your card(s) before the statement due date is also helpful. Don’t use more than 9% of your available credit card limit.

- making all of your payments on time. This one should be much easier to follow, especially if you set up your payments to go out automatically.

- having at least 9 years of credit history

- not having any recent credit inquiries

How to Check Your Credit Score

There are several ways to find out your current credit score. Most major financial institutions, including banks like Chase and USAA and credit card providers like Citi and Capital One, provide credit reporting as a service for their customers for free. The free credit reports you have access to through your bank or credit card issuer are summaries that don’t include many of the specifics that a full credit report contains. However, they are useful in that they provide your FICO score (or VantageScore in the case of Capital One and others that provide TransUnion data) from one of the credit bureaus score, and they give explanations about why your score is what it is.

To obtain your full credit report, you are legally entitled to get one for free from AnnualCreditReport.com, which is the only website sanctioned by federal law to provide free credit reports as commissioned by the Federal Trade Commission (FTC). You can also typically get a full report from lenders who have done a hard credit inquiry with the intent of assessing your creditworthiness.

If you want more frequent updates on your credit score so that you can be more vigilant about what’s affecting it, you can purchase a membership to a website like myFICO, where you can get updates credit reports and alerts for about $20 per month.

Keep Credit Scores in Perspective

When considering how to approach your credit score, it’s important to understand and remember that credit scores are far from everything, and having too much regard for a high credit score is an unhealthy financial perspective. If you are focused on your credit score too much and forget about other principles of prosperity and wealth building, you can be influenced to get loans that you don’t need or to become a responsible borrower in situations where you shouldn’t be borrowing or financing things at all.

Instead of worshiping at the altar of FICO (as financial guru Dave Ramsey has referred to it – see the video below), I recommend simply being responsible with your money, educated about how finances and investments work, and simply do has be most marginal benefit for you and your family, which is usually what simply makes sense, not necessarily what improves your FICO score.

Several years ago, when I purchase the home I live in now, I paid cash for it. My closing costs were less than $200. Had I spent the previous five-plus years worrying so much about getting a higher FICO score, it likely would have cost me enough interest and other expenses associated with credit that I wouldn’t have had the cash to pay for my home free and clear.

In my strong opinion, it’s almost always better to pay cash than to finance something, especially if your reason for financing something is merely to improve your FICO score.

Dave Ramsey’s Perspective on FICO

Dave Ramsey, a respected financial adviser who has published books and other learning resources about getting out of debt and managing money, rants once in awhile about an overemphasis on FICO credit scores.

I’ll end this article with this entertaining, if not educational, video of Mr. Ramsey sharing his strong (as always) opinion about what your perspective should be on your credit.