Lost Cashier’s Check? Here’s What to Do

A short while ago, I came across a notice of public auction for a foreclosed townhome that I was interested in picking up. I’m not a very experienced real estate investor (yet), but I thought I’d go give this one a try. I had to get on a plane and travel from Utah to Nashville, Tennessee, which would not ordinarily be a problem. However, I found out that I’d need to have with me at the auction a cashier’s check (or two) that could be used to immediately pay the Auction.com staff running the auction in the event that I won.

Getting a cashier’s check shouldn’t be too complicated, since the money ($230,000 was my personal bidding limit, so that’s how much I needed to bring) was in my bank account. As I got ready to book my flight, however, I realized that Chase, the bank I normally use for large expenditures, didn’t have a branch in Nashville. In fact, Chase (one of the largest banks in the country) doesn’t even have a bank branch in all of Tennessee! (Update, as of 2023, there now is a Chase Bank branch in Nashville, Tennessee and several other branches in the Middle Tennessee area.) That meant that I had to get my cashier’s checks (as recommended by the Auction.com staff, one for the minimum bid of $195,000, and one for $35,000 that would take me up to my $230,000 bid limit) from my local bank and haul it with me through security lines onto the plane, including making a connecting flight from Boston to Nashville.

The whole scenario was overwhelming for me.

What if I lost either or both of my cashier’s checks? From what I’d heard, if you lost a cashier’s check, it was like losing cash. As I found out, that’s not true. There are remedies for losing a cashier’s check, and I’ll explain them to you below.

In fact, I almost lost it on my plane from Salt Lake to Boston. Just before takeoff, the flight attendant told me that my backpack would need to go into the overhead bin instead of under my feet since I was sitting in the front row. I leaned over and whispered to him, “This bag is full of $230,000! I’d rather not be separated from it if at all possible.” That move was certainly not my most stealth one ever. To recover, I pulled the checks out of the bag and put them into my zip-up pants pocket, where it remained securely for the entire flight.

Upon my arrival to Nashville, I did some research on how the whole process works. Hopefully what I found out and will share below will help you feel more at ease (but still not be negligent or sloppy) about situations that involve cashier’s checks.

How a Cashier’s Check Works

When you get a cashier’s check from the bank, this is what happens.

The bank representative looks at the account you’ll be drawing the cashier’s check from and verifies that it contains enough of a balance (above any pending transactions on the account) that the money can be withdrawn from your account. When the cashier’s check is created, the funds are transferred from your own account to the bank’s general funds. The funds for the cashier’s check are then sourced, usually within a couple days after the check is deposited by the recipient, from the bank’s own general funds account.

If you’re nervous about whether your money is safe in the bank (considering threats from inflation, bank stability, the collapse of the dollar, etc.), it may be worth considering investing some of your cash into precious metals.

Because the fund amount listed on a bank issued cashier’s check are guaranteed by the bank’s own funds, a cashier’s check is considered guaranteed. That condition is what allows a cashier’s check to be the preferred method of use in transactions such as a foreclosure auction, when funds must be available immediately upon the close of the auction, and in a situation where a personal check or even certified check don’t provide enough security for the transaction.

In summary, when a cashier’s check is issued, the money from your personal account is immediately debited, and the guaranteed funds associated with the cashier’s check are withdrawn from the bank’s general fund within a day or two after the check is deposited by the recipient.

What if You Lose a Cashier’s Check?

If you lose a cashier’s check, there is a standard process for getting your money back into your account. The process involves several risk mitigating steps and normally involves a waiting period of up to 90 days before the funds are available again to you as an account owner.

Here are the steps you’ll take in a situation where you’ve lost a cashier’s check.

Declaration of Loss Statement

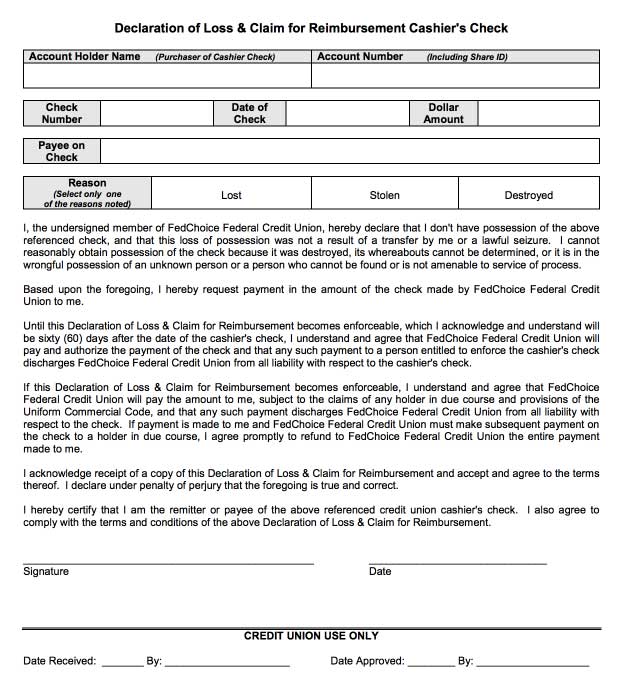

To begin the process of restoring the funds used to create your cashier’s check, you’ll first need to submit a Declaration of Loss statement to the financial institution from which you received the check. Most banks and credit unions have templates that can be used to submit this Declaration of Loss statement. Often the Declaration of Loss statement form is combined with a claim for reimbursement from the financial institution.

The Declaration of Loss Statement below (sourced from FedChoice Federal Credit Union) shows the standard verbiage used in this statement. In this example statement, the declared waiting period for the enforceability of the reimbursement claim is sixty days from the date the cashier’s check was issued. This means that your waiting period to receive a new cashier’s check (or to have the amount listed on the original check deposited back into your account) is 60 days.

Indemnity Agreement

In addition to declaring the loss of a cashier’s check, your financial institution will also require you to sign an indemnity agreement, which releases the bank or credit union from all responsibility if a situation arose where the check turned up and was somehow cashed or deposited. The Indemnity Agreement essentially makes you fully responsible for the outstanding amount of the lost cashier’s check. Once you’ve signed a formal Indemnity Agreement, the bank can re-issue your cashier’s check or return the funds to your own bank account.

Indemnity Bond

Before they will issue a replacement cashier’s check, many banks will require someone who has lost a cashier’s check to purchase an Indemnity Bond, which protects the bank from having to pay out on a cashier’s check twice. An indemnity bond makes you, the one who lost the cashier’s check, liable in case the original check shows up again and is cashed or deposited.

Indemnity Bonds can be purchased through insurance agencies who deal with that type of financial instrument. Purchasing an indemnity bond will cost you around 2% of the amount listed on the lost cashier’s check.

What if a Cashier’s Check is Destroyed?

In their Declaration of Loss statement templates and indemnity agreements, financial institutions who issue cashier’s checks tend to treat missing checks the same way, which means that it doesn’t typically matter what happened to the check, whether it was lost, stolen, or destroyed. The terminology they typically use covers all three of those instances.

However, if you can reasonably prove to your bank that your cashier’s check was destroyed rather than lost or stolen, it is likely that their terms for correcting the loss may be more favorable. Also, your worry about the check showing up later and being cashed by someone other than the intended recipient will be much less than if the check was lost or stolen. If you’re required by your check issuing bank to purchase an indemnity bond, it may be easier and/or cheaper to obtain the bond if you can convince the bond issuer that the check was destroyed.

Should You Mail a Cashier’s Check?

If you’re considering whether to mail a cashier’s check to someone, here is a word of caution: the United States postal service is notorious for losing mail and packages. As a quasi-governmental agency, it’s only natural that the post office is less accountable than private couriers like DHL, FedEx, and UPS.

To avoid the stress of wondering whether your check is going to be delivered, I’d recommend using UPS, FedEx, or DHL and overnighting the check in cases where you absolutely must send someone a cashier’s check. If you can avoid having to mail something that acts almost like cash as a cashier’s check does, I’d choose a different payment method that doesn’t depend on sometimes moody delivery drivers and other hands that will handle your express letter along the way.

Alternatives to Cashier’s Checks

As mentioned above, there are several alternatives to using a cashier’s check. Wiring money is my top recommendation as an alternative. You can also send money guaranteed via money orders, Western Union, money transfer services like Xoom (a PayPal company), and several other similar methods that limit your liability compared to a cashier’s check.

What If A Lost Cashier’s Check is Cashed by the Wrong Person?

Cashier’s check fraud is a growing problem in the United States, but in most cases, fraud schemes involve people creating fake cashier’s checks during business and personal interactions such as the sale of a product remotely.

In order for someone to deposit your lost cashier’s check, he or she would need to sign it over to himself by forging your signature. Signing a cashier’s check to someone else involves writing “Pay to the order of [new check owner’s name]” in the endorsement section on the back of the check. The original owner’s signature must appear below the verbiage signing the check over to a new owner.

Banks normally have strict rules about accepting cashier’s checks that have been signed over from the original recipient to someone else. In order for the bank to accept a signed over check, the bank typically must know the new check owner and have some background on why he would be having a cashier’s check signed over to him. For instance, a common situation where a cashier’s check is signed over to someone other than the original payee is at a foreclosure auction for real estate. In these scenario, the common protocol is for auction bidders to have cashier’s checks made out to them for the amount they intend to bid. Once the auction has closed, the winner signs over his cashier’s check to the auctioneer to deposit into an account designated for the auctioneer’s organization. Their bank understands their field of business, and therefore would be willing to accept for deposit on a regular basis signed over cashier’s checks.

On the other hand, if someone found a lost cashier’s check, fraudulently signed it over to himself, and attempted to deposit the check, the bank would typically need to be familiar with the depositor, and would go through some security checks to ensure that there wasn’t fraud being committed. This is especially true if the cashier’s check involves large sums of money, in the range of $10,000 and above.

It’s useful to know that there are checks in place to prevent the depositing or cashing of a lost or stolen cashier’s check. However, in the rare case that someone finds a lost cashier’s check or steals it intentionally, if that person is able to convince the bank that the check is legitimately his, there is very little remedy that can be used to recover those funds. People who commit this kind of check fraud are typically experts at covering their tracks.

If you find yourself in the very unlucky position of having lost a cashier’s check, and having that check found and deposited by an unscrupulous person, you need to quickly consult an attorney that is familiar with check fraud laws and procedures for recovery.

Legal Information Regarding Cashier’s Checks

If you’d like to read the official legal description of the laws involved with a lost or stolen cashier’s check, you can visit Cornell University online publication of UCC § 3-312, which governs lost, stolen, or destroyed cashier’s checks, teller’s checks, and certified checks.

General Advice and Caution Regarding Cashier’s Checks

Hopefully the information in this article has helped you to better understand what’s at stake when a cashier’s check is lost or stolen (or destroyed). Considering the fact that there are several backups and remedies, you’re not entirely exposed to risk should you lose one, but the best approach would be to exercise adequate caution and preempt a situation where you have to fix a potential money problem after the fact. Especially if you’re dealing with large amounts of money wrapped into a cashier’s check, it’s best to either limit the amount of time the cashier’s check is outstanding or even to find an alternate method of payment.

One Comment