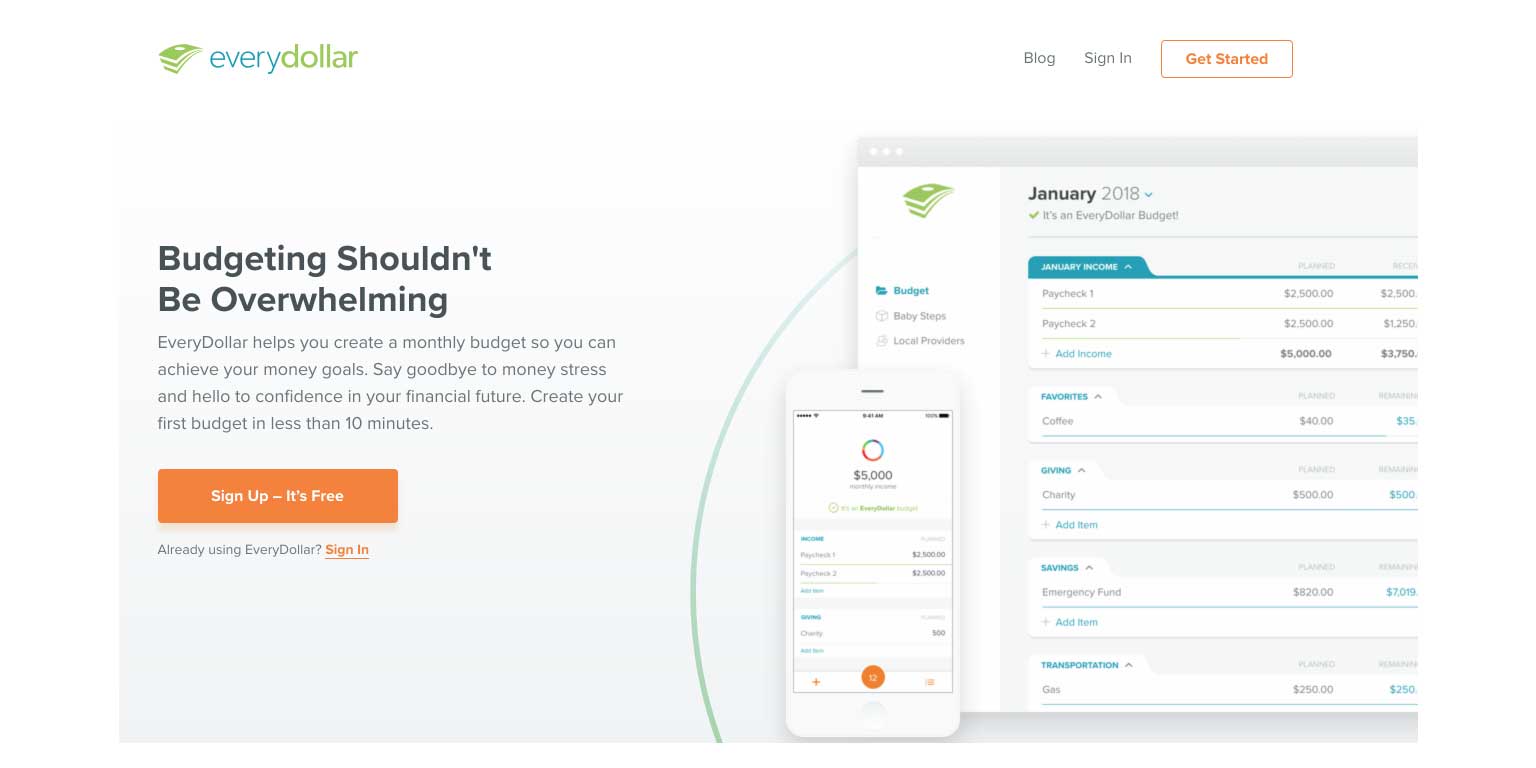

EveryDollar – The Free Budgeting App from Dave Ramsey

EveryDollar is a budgeting application that is used by millions of people and families to keep track of how they spend their money and to do other budgeting activities. The EveryDollar app is a comprehensive monthly budgeting tool, allowing users to enter and track income and expenses on a monthly basis so that they can be compared to their planned budget. EveryDollar also facilitates categorizing and classifying income and expenses to allow users to get an administrative view of the flow of money into and out of their possession.

The creator of EveryDollar, Dave Ramsey, has been a well-respected and highly trusted advocate of financial responsibility (a trait that has been steadily in decline in an increasingly material society) since the 1990s. His nightly talk radio show, The Dave Ramsey Show, has an audience in excess of 12 million people who tune in regularly to hear advice from Ramsey and his occasional guests about topics such as how to get out of debt and establishing financial habits that are fundamental to prosperity and financial security. Ramsey has also written some best selling books based on a Christian view of managing finances, including Financial Peace and EntreLeadership.

The EveryDollar budgeting tool is modeled to fit well with the principles taught by Dave Ramsey in his Financial Peace University training, a 9-week course that includes 7 popular “baby steps” for people seeking to pay off debt and build wealth. Those steps include:

- Baby Step 1 – $1,000 to start an Emergency Fund

- Baby Step 2 – Pay off all debt using the Debt Snowball

- Baby Step 3 – 3 to 6 months of expenses in savings

- Baby Step 4 – Invest 15% of household income into Roth IRAs and pre-tax retirement

- Baby Step 5 – College funding for children

- Baby Step 6 – Pay off home early

- Baby Step 7 – Build wealth and give!

The EveryDollar app doesn’t address these baby steps specifically, but it provides a framework, through disciplined budgeting, for accomplishing the steps listed.

EveryDollar doesn’t have to be used in conjunction with the Dave Ramsey approach to financial prosperity and budgeting. In fact, many users of EveryDollar are followers of other financial mentors.

EveryDollar can be used via a web browser. It is also available for download on Android devices through the Google Play store and iOS devices through the App Store. When I review the monthly budget for my family with my wife, we typically use the browser version of EveryDollar since it’s easier for sharing a screen and input can be done more quickly. However, having the EveryDollar app available makes it easy to input expenses at the gas pump, restaurants, or elsewhere on the go.

My Own Experience with EveryDollar

My wife and I recently participated in a personal finance course sponsored by the LDS Church as part of its self-reliance initiative. During the course, which involves finding and making use of a budgeting tool, we chose EveryDollar as our record-keeping system. We found the app easy to setup and use, including via a web browser and on our mobile devices. During the time we used the EveryDollar app regularly, we discovered a lot about our spending and other financial habits. We were surprised at how much we spend on things that weren’t really priorities for our family.

We also re-learned some concepts that I’ve been familiar with for a long time. First, software systems are only as good as your discipline and commitment to using them for their intended purpose. Second, having accountability (action partners in our case during the period we took the course) can be a big help, and can often influence you to do something you know you should do, but that you otherwise don’t have the innate discipline to do. While we were the class, we used EveryDollar on a daily basis, and it helped us a lot to make proactive decisions about both earning and spending money. Since the course’s conclusion, we have fallen back into bad habits, which means that we haven’t opened up the EveryDollar app in several months.

Update 1/27/20:

My wife and I are once again taking the Personal Finance LDS self-reliance class with the hope of restarting and reinforce the habits we developed years ago when we took the course. It’s been convenient and enlightening having the ability to recall the EveryDollar budget we set up awhile ago. Most of the people in our current class are planning to use EveryDollar. Another alternative that seems promising as well is Mint.com, which also have a highly useful free version.